NatWest Group plc (NWG)

NatWest Group plc (NWG)

Previously known as:

Previous Name: ROYAL BANK OF SCOTLAND GROUP PLCPrevious TIDM: RBS

Voting and Company Information

NatWest Group plc Company Information and Vote Guidance 2025

AGM: 23rd April 2025

Proxy deadline: 17th April 2025

ShareSoc provide this added value voting information service for Full Members only, providing background information on leading companies and AGM vote guidance.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 23rd April AGM based on their standard template.

3. Minerva detailed research report for the AGM.

Summary of voting issues at this year’s AGM

The Minerva report highlights various issues and recommends voting against nine of the resolutions, and one on a case-by-case ...

NWG – NatWest Group plc Information and Vote Guidance 2024

AGM: 23 April 2024

Proxy deadline: 19 April 2024

ShareSoc provide this added value voting information service for Full Members only, providing background information on leading companies and AGM vote guidance.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 23 April 2024 AGM based on their standard template.

3. Minerva detailed research report for the AGM.

Summary of voting issues at this year’s AGM

The Minerva report highlights various issues and recommends voting against three of the resolutions and for two to ...

Post Date: April 4, 2024

Read more

NWG – Natwest Group plc Information and Vote Guidance 2023

ShareSoc introduced this new added value voting information service for Full Members only in 2021, providing background information on leading companies and AGM vote guidance. Initially, we are piloting this for FTSE30 companies, plus a few others in the FTSE100. We have decided to continue the pilot in 2023 and are looking at ways to improve our services to members.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 25 April 2023 AGM based on their standard template.

3. ...

Post Date: April 6, 2023

Read more

NWG – NatWest Group Information and Vote Guidance 2022

This report is by Cliff Weight, Director, ShareSoc. These are my personal views and not necessarily those of ShareSoc. I own shares in NWG but am very underweight(!). ShareSoc...

Post Date: April 21, 2022

Read more

NWG NatWest Group – Company Information and Vote Guidance

by Cliff Weight, Director ShareSoc. These are my personal views and not necessarily those of ShareSoc. I own shares in NWG.

ShareSoc has introduced a new added value service, for Full Members only, providing background information on leading companies and AGM vote guidance. Initially we are piloting this for FTSE30 companies, plus a few others in the FTSE100.

You can access all the information that ShareSoc has written on a company by clicking on the Research and Company Research buttons in the header ...

Post Date: April 21, 2021

Read more

Blog posts

NWG NatWest Group – Company Information and Vote Guidance

by Cliff Weight, Director ShareSoc. These are my personal views and not necessarily those of ShareSoc. I own shares in NWG.

ShareSoc has introduced a new added value service, for Full Members only, providing background information on leading companies and AGM vote guidance. Initially we are piloting this for FTSE30 companies, plus a few others in the FTSE100.

You can access all the information that ShareSoc has written on a company by clicking on the Research and Company Research buttons in the header ...

Post Date: April 21, 2021

Read more

RBS Virtual Shareholder Event, Thursday 16 July 2020

I am looking forward to this virtual shareholder event and have registered.

RBS had a closed AGM (due to Covid) and promised this event for retail shareholders so they could ask the questions they would have liked to have asked at the AGM.

Now is your chance to listen to RBS management and ask your questions.

To secure your place, please register by 10th July here if you know your SRN (shareholder registration number which you can find on your share certificate). You will then receive a confirmation ...

Post Date: July 4, 2020

Read more

Why the FCA Did Nothing About the Lloyds TSB Abuse

Those who were Lloyds TSB shareholders back in 2009 when they merged with HBOS to form Lloyds Banking Group (LLOY) thought it was bad deal at the time and it certainly turned out to be so. HBOS had many dubious loans to property companies and when the banking crisis arose they were in deep financial difficulty. There seemed very little benefit in the merger for Lloyds shareholders

Subsequently a legal action was launched by the disgruntled Lloyds TSB shareholders which was lost ...

Post Date: June 16, 2020

Read more

RBS Shareholder Campaign and AGM voting recommendations – Update 18, 17 April 2020

RBS could do better! It would be wrong to lambast RBS in the eye of the COVID-19 storm, but we note the following issues:

2020 AGM solution requires voting before discussion

Directors’ shareholdings are too small – no alignment with shareholders

No information on potential loan impairments from COVID-19 pandemic

Market cap of £12bn is too small versus £723bn total assets

The RBS Board has in this time of crisis, reverted to type – communication flows and quality of ...

Post Date: April 17, 2020

Read more

Brexit Bounce, Green Accreditation, Security Issues and Hargreaves Lansdown AGM

The FTSE and my portfolio jumped up this morning (11th October) on the hope of a Brexit Agreement after all. RBS is up 16% which seems to be a...

Post Date: October 14, 2019

Read more

RBS Shareholder Event 10 September 2019

RBS held a successful shareholder event at their London HQ on 10 September 2019, attended by about 90 shareholders. There is clearly demand, from many shareholders, to attend such...

Post Date: September 23, 2019

Read more

RBS Shareholder Event Tuesday 10 September 2019, 6pm – 8pm in London.

I am very pleased to report progress at RBS on shareholder engagement with individual investors.

The next event will take place on Tuesday 10 September 2019, 6pm – 8pm in London.

If you are interested in attending this event please email your full name, postcode and Shareholder Reference Number (if known) to rbseventlondon@computershare.co.uk by Friday 23 August 2019.

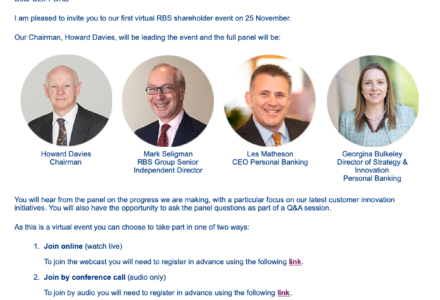

On the 25 November 2019 RBS are planning a virtual shareholder event. Further information regarding this event and how to participate will be made available soon.

I ...

Post Date: August 6, 2019

Read more

Excessive Pensions, Lloyds Bank and RBS

Over 20% of shareholders voted against the Lloyds 2017 Remuneration Report. Lloyds then consulted with shareholders, but this still resulted in the awful recent press. Clearly the engagement process did not work.

I therefore call for Lloyds Bank to implement a Shareholder Committee, which is a more formal and regular engagement process, which builds trust and understanding between committee members and the company. This can only improve the current processes.

The Lloyds 2018 annual report says:

Responding to feedback

We were disappointed that our ...

Post Date: March 21, 2019

Read more

Unhelpful Computershare provide RBS register in ugly pdf format

I am writing this blog to castigate Computershare for their unhelpful service and suggest that registrars should be required to respond to valid register requests with a more usable response.

I recently requested a copy of the RBS register of shareholders. I wanted this so we could write to RBS shareholders about the upcoming resolution for a shareholder committee at the 2019 RBS AGM.

Despite repeated requests, Computershare refused to provide the register in a user friendly format. I know that the Computershare system is capable of ...

Post Date: February 14, 2019

Read more

RBS General Meeting Report

98.7% of shareholders voted for the proposal, with 1.3% against. A very strong majority. UKGI did not vote their shares.

I watched the General Meeting on the webcast. Attendance looked pretty thin. Three people asked questions. Neil Mitchell questioned the prudence of using company funds to buy back shares when there was £15bn of GR legacy issues claims outstanding. He also questioned why there had to be so much haste (why not wait until the AGM and after the annual results were ...

Post Date: February 6, 2019

Read more

RBS General Meeting: You Decide!

I have today published two posts on ShareSoc's blog, expressing different opinions on RBS's proposed resolution to buy back shares from HM Treasury. One from our chairman and another from senior ShareSoc member Roger Lawson.

Firstly, the facts. You can find full details of the General Meeting and proposal here: https://investors.rbs.com/shareholder-centre/shareholder-meetings.aspx. If you are a shareholder you should study the circular available from that webpage before deciding how to vote.

ShareSoc encourages its members to make their own minds up on matters such as ...

Post Date: January 22, 2019

Read more

RBS Share Buy-Back

The Royal Bank of Scotland (RBS) is proposing to buy-back up to 4.99% of its shares from the stake held by the Government (by UKGI on its behalf). At present the Government holds 62% of the company stemming from the bailout in the banking crisis ten years ago. They have been trying to get shot of it ever since as no Tory government thinks it should be investing in banks. This latest proposal makes it clear that UKGI cannot easily sell ...

Post Date: January 22, 2019

Read more

RBS General Meeting – Voting Considerations

RBS has called a General Meeting for 6th February to consider a Special Resolution giving the group the authority to make off-market purchases of up to 4.99% of the outstanding shares from HM Treasury. In effect this is an authority to effect a capital reduction, which will partially reduce the overhang of government held shares.

The timing is pretty poor, coming just three months prior to the AGM and without the benefit of full year financial reports. But it seems to signal ...

Post Date: January 22, 2019

Read more

Banks Claims Group Limited, FCA and RBS

Neil Mitchell, who ran Torex Retail before he blew the whistle on an earlier fraud at the software company and RBS’s Global Restructuring Group took control of the business, has applied for a judicial review of a UK Financial Conduct Authority decision in July that its options for taking action were “limited”. Neil, who claims to represent 530 complainants affected by alleged wrongdoing at GRG, alleges in his judicial review application that the FCA has been “unlawfully refusing or failing” to ...

Post Date: December 7, 2018

Read more

Lax Regulation (Globo, GRG) and Japanese Trust AGM

Globo was one of those AIM companies that turned out to be a complete fraud. Back in December 2015 the Financial Reporting Council (FRC) announced an investigation into the audits of the company by Grant Thornton (GT). Even the cash reported on the balance sheet in the consolidated accounts of the parent company proved to be non-existent (or had been stolen perhaps). I have previously complained about the slow progress and the lack of any information on this investigation.

But former shareholders ...

Read more

Whose company is it anyway?

Paul Jackson wrote an in-depth analysis of the RBS Shareholder Committee campaign and the issues raised in the prestigious Investors Chronicle, 22 June 2018 issue, which is read by tens of thousands of investors. We are grateful to Paul and Investors Chronicle for giving us permission to reproduce this article.

A rather strange thing happened at the RBS annual general meeting at the end of last month. UK Government Investments (UKGI) used its 70 per cent stake to help scupper a resolution ...

Post Date: July 5, 2018

Read more

RBS Sale and Blackrock Smaller Companies AGM

The Government is selling off another tranche of its holding in the Royal Bank of Scotland (RBS). By selling another 8% it will reduce its holding to 62% of the company. The Government (or “taxpayers” as some described them) will face a loss of about £2 billion on what it originally paid for the shares. There were howls of protest from some politicians. John McDonnell, shadow chancellor, said “There is no economic justification for this sell-off of RBS shares. There should ...

Post Date: June 6, 2018

Read more

RBS, Shareholder Committees, LTIPs and Weir

It is good news that the Royal Bank of Scotland (RBS) have accepted a requisition for a resolution on a Shareholder Committee at their forthcoming AGM. ShareSoc and UKSA, who jointly promoted this under the leadership of Cliff Weight have issued a press release confirming the resolution has finally been accepted after some legal evasions to try and avoid it.

Shareholder Committees are a way to improve corporate governance at companies and ensure that the views of shareholders (and potentially other stakeholders) ...

Post Date: March 20, 2018

Read more

Regulation of shareholder action groups following the debacle of the RBS case

Regulation of shareholder action groups following the debacle of the RBS case (see http://www.thisismoney.co.uk/money/news/article-5266449/Demand-probe-RBS-Shareholders-Action-Group.html ).

As regards the suggestion that such groups be “regulated”, I do not see how that would necessarily assist to protect the interests of shareholders. Indeed, it might result in even more involvement of lawyers when one of the big problems is that legal firms often set up and run such groups and this is often in their interests rather than the claimants. Introducing regulation would also make ...

Post Date: January 16, 2018

Read more

RBS Campaign Update 9 – Progress as at 13/12/2017

If you have not yet joined the campaign you can still do so, please click here to download the forms https://www.sharesoc.org/rbs-agm-2018-requisitions/ .

EMAIL 1 sent out on 24 Nov 2017 and 80 new campaign members recruited.

Resolution and Request for discussion finalised. Click here to see them.

EMAIL 2 sent out on 9 Dec 2017 to all campaign members asking them to sign the forms and return them to us. 30 received so far. We need at least 100 ...

Post Date: December 13, 2017

Read more

ADVFN Results and More on Lloyds

ADVFN Plc (AFN) published their results for the year to June yesterday. I have a very small holding in the company (acquired for reasons I won’t go into). ADVFN are information providers on the stock market, primarily to private investors. Many people monitor their bulletin boards although like many such boards frequented by private investors, they are somewhat of a curate’s egg so far as serious or sophisticated investors are concerned.

But they certainly have a large following – they say they ...

Post Date: October 24, 2017

Read more

Lloyds Litigation, Collective Redress, and CLIG AGM

I went to the High Court in London this morning to hear the grilling of witnesses in the case brought by shareholders over the acquisition of HBOS by Lloyds. But I was disappointed to find when I got there that the first session was to be held in private – presumably the judge wants to discuss some legal issues with counsel for both sides. So I went to the AGM of City of London Investment Group (CLIG) instead where I hold ...

Post Date: October 23, 2017

Read more

Rbs Snub to Chris Philp MP and Next Steps

Gavin Palmer was at the Tory Party Conference and in discussion with Chris Philp, MP, where it emerged that Chris had written three times to RBS asking Sir Howard Davies, RBS Chairman why they were objecting to our shareholder resolution for a Shareholder Committee. Regular readers will be aware that it was Chris who wrote an excellent paper covering Shareholder Committees in September 2016 which received wide publicity. See http://highpaycentre.org/files/HPC_42_WEB_amend_-_Restoring_Responsible_Ownership.pdf

Despite Chris’ best efforts, RBS rebuffed his questions and refused to share their legal ...

Post Date: October 21, 2017

Read more

HBOS and Lloyds Legal Case

This week sees the start of the legal case in the High Court by investors in the Lloyds TSB over the acquisition of HBOS – opening submissions are on Wednesday and it’s scheduled to run through to March next year. Anyone can attend these hearings of course but I think it will take a very patient person to sit through all of it. I have submitted written evidence on behalf of the litigants (represented by Harcus Sinclair) but it seems I ...

Post Date: October 17, 2017

Read more

Obituary – Steve Marshall

The Daily Telegraph ran a lengthy obituary on Steve Marshall today, who died recently at the young age of 60. It covered his financial career in a not particularly complimentary way although some might say he took on a lot of difficult positions.

He first came to public prominence when he became CEO of Railtrack after Gerald Corbett was forced to resign, despite having minimal experience of the railway industry. Railtrack was part of the former British Rail that had been privatised ...

Post Date: October 10, 2017

Read more

RBS Shareholder event hijacked by other stakeholder groups

RBS announced excellent results today (4/8/17) and their share price soared 4% to £2.67 in early trading. For detailed commentary see http://www.telegraph.co.uk/business/2017/08/04/rbs-posts-rare-half-year-profit-eyes-amsterdam-move-staff/ . Things are looking better. The RBS...

Post Date: August 4, 2017

Read more

RBS Shareholder Event on 31 July

I am looking forward to the RBS Shareholder Event on Monday 31 July in London. RBS had dropped regular shareholder briefings, but, following our shareholder committee campaign, have now reinstated...

Post Date: July 26, 2017

Read more

RBS payout may trigger other group litigations

RBS £200m payout could lead to similar group litigation brought by small investors in other companies. You may recall that investors alleged that RBS had misled them over the...

Post Date: June 11, 2017

Read more

RBS case shows why trust must be rebuilt in business

Letter in the FT from ShareSoc Director Cliff Weight on why the SFO, CPS and/or BEIS should be given more resources and told to pursue problem cases much more...

Post Date: June 1, 2017

Read more

RBS Potential Settlement: Where’s the Justice?

It seems that the major players in the RBS Action Group have accepted the latest RBS offer. See http://files.constantcontact.com/2fe662f5101/de78446f-b327-4d5e-9eee-5fcd584c7e8c.pdf

This has, in effect, enabled RBS to bully the small individual shareholders into also accepting the settlement. I say “bully” because RBS are threatening anyone who pursues the case to risk having costs awarded against them.

So now the case will be settled. No-one will be found guilty. RBS will pay out £800 million (of shareholders’ money) to a group of its shareholders without ...

Post Date: May 28, 2017

Read more

A tale of three AGMs

by Cliff Weight

Last week I went to 3 AGMs. Aviva on Wednesday, 10 May in London and then Lloyds in the morning of the 11th and RBS in the afternoon, both in Edinburgh.

Aviva was very well attended with about 600 people in the Queen Elizabeth Centre. There were plenty of displays of the Aviva products, lots of staff to explain them and deal with any customer issues or complaints. There were also stands explaining the business (noticeable by its absence was ...

Post Date: May 17, 2017

Read more

RBS, Akzo Nobel and Hornby

The Royal Bank of Scotland (RBS) AGM is tomorrow and it will be interesting to see what excuses the board of directors give for rejecting the requisition of a resolution to establish a Shareholder Committee. ShareSoc believes the rejection has no sound legal basis and ShareSoc directors will raise this issue at the meeting.

Another similar case is that of Akzo Nobel in Holland where Elliott Advisors have been pushing the board to consider a takeover offer from US company PPG Industries. ...

Post Date: May 10, 2017

Read more

Banks and Bank Credit Card Accounting

It's going to be exciting week next week for RBS and Lloyds Bank shareholders with both AGMs on Thursday in Scotland - we expect to issue a report on events. Indeed it's going to be an exciting period ahead because the law suits by those investors in the RBS rights issue who have not yet settled, and an action over the takeover of HBOS by LloydsTSB, are both getting into court in the next few months. Having Fred Goodwin on the witness ...

Post Date: May 2, 2017

Read more

RBS AGM Voting Recommendations

ShareSoc has today issued the following press release giving voting recommendations for the Annual General Meeting of the Royal Bank of Scotland (RBS):

ShareSoc recommends voting against the following resolutions at the Annual General Meeting (AGM) of RBS: 2 Remuneration Policy, 3 Remuneration Report, 4 Chairman Howard Davies, 12 NED Penny Hughes and 24 General Meetings at 14 day notice.

RBS have continued to resist our request for a shareholders’ resolution to be put to the AGM for the establishment of a Shareholder ...

Post Date: April 11, 2017

Read more

Hard Hitting BEIS Report on Corporate Governance and Pay

The BEIS Commons Select Committee have today published a strongly worded report on Corporate Governance after its recent hearings on the subject. Here are some of the key points they make:

They agree with the Prime Minister that high levels of executive pay need to be tackled "for the benefit of society as a whole". They forcefully recommend that Long Term Incentive Plans (LTIPs) should be abolished as soon as possible because they create perverse incentives and are often a way ...

Post Date: April 5, 2017

Read more

FT Article on RBS and Shareholder Committees

The Financial Times have published an article under the headline "Investors fight RBS snub to shareholder committee move". It covers the battle by ShareSoc to get the Royal Bank of Scotland to accept a resolution for their AGM to appoint a Shareholder Committee. See the ShareSoc campaign web page here for more explanation of the benefits of such a Committee and how RBS are currently thwarting shareholder democracy: https://www.sharesoc.org/campaigns/rbs/.

One of the supporters of this concept to improve corporate governance and reign in ...

Post Date: April 2, 2017

Read more

Share issues – And An Interesting Rule

Spring is in the air, and companies are clearly in a mood to raise cash. A lot of these have been share placings but the reasons given have been...

Post Date: March 12, 2017

Read more

RBS and Shareholder Committees

As readers may be aware, ShareSoc have requisitioned a resolution for the Royal Bank of Scotland's (RBS) Annual General Meeting requiring a Shareholder Committee be appointed. Do they need one? The directors of RBS clearly think not.

For those readers who do live or work in London, you may find an article published yesterday (15/2/2017) in the London Evening Standard giving an overview of the major UK banks revealing. The article was written by Simon English and was headlined "End of the ...

Post Date: February 16, 2017

Read more

RBS Rejects Democracy

ShareSoc has today issued the following press release: The Royal Bank of Scotland (RBS) has rejected a requisition to implement a Shareholder Committee. ShareSoc will not permit this unreasonable...

Post Date: February 1, 2017

Read more

New Year Resolutions? How About a New Resolution at RBS?

One of ShareSoc's recent initiatives has been the promotion of the concept of Shareholder Committees as a way of improving corporate governance in public companies. To pursue this agenda we have today submitted a requisition for a resolution to be added to the Annual General Meeting of the Royal Bank of Scotland (RBS). A summary of what it said is given below (the full press release is here: https://www.sharesoc.org/pr85-rbs-shareholder-committee.html ):

RBS Shareholders Demand Shareholder Committee

(A joint press release on behalf of Private ...

Post Date: December 30, 2016

Read more

Fenner AGM Requisition. Why Is It Not a Good Idea?

Fenner Plc (FENR) are the subject of a requisition of a resolution to appoint another director at their forthcoming Annual General Meeting on 11th January. ShareSoc is particularly interested in requisitioned resolutions at present because we are trying to get one added to the Royal Bank of Scotland AGM (see www.sharesoc.org/campaigns/rbs/).

In the case of Fenner, activist Swiss investor Teleios Capital Partners have put forward the requisition, with the support of a number of other investors. Teleios hold over 5% and have ...

Post Date: December 23, 2016

Read more

Campaign to Obtain Shareholder Committee at RBS

This note has been issued by ShareSoc to its Members (but anyone can join in to support the campaign): ShareSoc has advocated the implementation of Shareholder Committees since our...

Post Date: December 14, 2016

Read more

RBS Settlement Announced – But Why Has the FCA Done Nothing?

The Royal Bank of Scotland (RBS) have announced a settlement of the litigation over the rights issue in 2008 with three out of the five investor groups who were pursuing the company. They have reserved £800 million to settle all the claims and are continuing to negotiate with the remaining litigants. But private investors may be reluctant to settle because of the high legal costs that will erode any settlement, the low value of the settlement (the claims were originally estimated ...

Post Date: December 5, 2016

Read more

RBS and Pre-Packs

The FT carried a story on Saturday (11/6/2016) which was a blast from the past. It reported that Neil Mitchell, a former CEO of Torex Retail, had filed a claim in the high court against Royal Bank of Scotland (RBS), Cerberus and KPMG in relation to the sale of the company at the time it went into Administration.

This case goes back to 2007 when Torex Retail got into financial difficulties after some fraudulent accounting came to light (which resulted in subsequent ...

Post Date: June 12, 2016

Read more

More Bad News for Banks and their Investors

If there are any private investors still invested in major UK listed banks, last week (w/e 30/1/2016) was yet another for disillusionment. In the Financial Times, Lex hit the nail on the head when he said "The one-offs keep on coming. If one did not know better, one might suspect them of being two-, three-, or more-offs". He was referring to Royal Bank of Scotland (RBS), but other banks likewise posted bad news during the week. Let's take them in turn:

RBS ...

Post Date: January 30, 2016

Read more

Goodwin still on the hook for RBS debacle

The Herald newspaper have reported an astonishing attempt by the lawyers for Royal Bank of Scotland (RBS) to have Fred Goodwin excluded from the legal case over the rights issue in 2008. They wanted four former directors removed from the case so as to streamline proceedings. However the judge presiding over the case threw this attempt out.

The directors signed off the prospectus and hence should surely be accountable for what the plaintiffs claim was a misleading document. But the lawyer for ...

Post Date: August 3, 2015

Read more

Enormous Costs of Royal Bank of Scotland (RBS) Legal Action

There was an interesting article by Geoff Ho in the Sunday Express yesterday (31/5/2015) on the law suit being pursued by shareholders against RBS. He reports that the RBoS Shareholders Action Group was presented with a bill for £1.2 million by its former solicitors Bird & Bird and a demand for "prompt payment" after they changed lawyers to Fladgate following concerns over costs and communication. Indeed the original demand was even higher but was subsequently reduced. Fladgate are working on a ...

Post Date: June 1, 2015

Read more

Law suits – Quindell, Lloyds, RBS and SIPPs

Feel misled by the Quindell board and its advisors? Then there is a new legal action being formulated by Liverpool legal firm "Your Legal Friend". They already claim to have 250 investors interested in pursuing a claim on the basis that statements issued by the board and its advisors show that insufficient care had been taken in relation to the duty of care owed to investors. At least that's a brief summary of the allegations - see their web site for ...

Post Date: December 21, 2014

Read more

Tesco Legal Action – or should we just “put our hands up”?

Law firm Stewarts Law has announced that it is preparing a case against Tesco based on the losses of investors in the company from the overstatement of profits. To quote from their announcement: "The Claim will allege that directors and senior management knew or were reckless as to whether Tesco's statements to the market were untrue or misleading and/or dishonestly concealed the true position, in breach of the Financial Services and Markets Act". They don't intend to await the results of ...

Post Date: November 30, 2014

Read more

Cyber threats and how to avoid them

The International Organisation of Securities Commissions (Iosco) has warned about the growing threats of cyber attacks to financial institutions. The Chairman, Greg Medcraft, has warned that there needs to be a much more concerted effort to tackle such threats. For example disruption of a stock exchange for any length of time could have serious consequences. Securities regulators who are members of Iosco are seeing increased attacks with more than half of securities exchanges being the subject of one or more.

The closure ...

Post Date: August 26, 2014

Read more

Pay at RBS – over 99% in favour

The Royal Bank of Scotland (RBS) held its Annual General Meeting yesterday (the 25th June). Most of the media did not even bother to report it.

There were some shareholders present who spoke against the remuneration at the company, but when it came to a vote the proxy counts were 99.81% in favour of the Remuneration Report and 99.66% in favour of the Remuneration Policy. PIRC had also opposed the Remuneration Policy before the meeting. A summary of what they said is ...

Post Date: June 26, 2014

Read more

Royal Bank of Scotland – more losses and downsizing

Royal Bank of Scotland (RBS) announced yet another set of disappointing results yesterday (27/2/2014). The share price closed down 8% on the day and is now way below what the Government paid for its majority stake in the business. New chief executive Ross McEwan announced the results after the previous one, Stephen Hester, had departed to sort out another basket case - RSA (formerly Royal and Sun Alliance). It was certainly an opportune moment to move on.

Last year RBS managed to ...

Post Date: February 28, 2014

Read more

Hibu, a most peculiar EGM, and RBS

In a previous blog post on the 28th Nov I discussed Royal Bank of Scotland (RBS) and the "unacceptable face of banking". It mentioned the case of HIBU, where RBS was one of the lenders, which had just been put into administration thereby apparently thwarting the calling of a General Meeting (EGM) by shareholders and the appointment of new directors. This was similar to the case of Torex retail some years before.

In fact the HIBU EGM did actually take place but ...

Post Date: December 5, 2013

Read more

RBS, Hibu and the unacceptable face of banking

There have been extensive media comments lately on the activities of the Royal Bank of Scotland in lending to smaller businesses, and what they did when those businesses got into financial difficulties. The articles printed focussed on two reports on the activities of RBS - a report commissioned by the bank by Sir Andrew Large, and one by Lawrence Tomlinson* who acts as a consultant to the BIS Department. Both reports, but particularly the latter one, were quite damning about the ...

Post Date: November 28, 2013

Read more

AGM Reports

RBS (RBS) AGM Report 2017

The RBS AGM meeting in Gogarburn was the worst by a long way that I have ever attended. It was scheduled to start at 2pm, which meant it was impractical to attend both the Lloyds meeting which started at 11am and the RBS meeting. Cock up or conspiracy? I suspect the latter, as a means of reducing the number of attendees, but either explanation is bad.

Coffee and biscuits were served before the meeting, which was rather meagre for those who had ...

ShareSoc News

NatWest Group plc Company Information and Vote Guidance 2025

AGM: 23rd April 2025

Proxy deadline: 17th April 2025

ShareSoc provide this added value voting information service for Full Members only, providing background information on leading companies and AGM vote guidance.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 23rd April AGM based on their standard template.

3. Minerva detailed research report for the AGM.

Summary of voting issues at this year’s AGM

The Minerva report highlights various issues and recommends voting against nine of the resolutions, and one on a case-by-case ...

Post Date: April 10, 2025

Read more

NatWest Group plc Shareholder Event 28 Nov 2024

Shareholder Engagement – NatWest is becoming a role model for other listed companies to follow

NatWest has announced a Virtual Shareholder Event at 6:00pm on Thursday 28 November 2024 for individual investors.

The event offers an opportunity for you to join Chair, Rick Haythornthwaite, and CEO, Paul Thwaite, and ask them questions.

NatWest (formerly RBS) now delivers a series of events for individual shareholders. The AGM is typically in late April/early May, preceded by a virtual shareholder event, giving investors the opportunity to ask questions ...

Post Date: November 20, 2024

Read more

NWG – NatWest Group plc Information and Vote Guidance 2024

AGM: 23 April 2024

Proxy deadline: 19 April 2024

ShareSoc provide this added value voting information service for Full Members only, providing background information on leading companies and AGM vote guidance.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 23 April 2024 AGM based on their standard template.

3. Minerva detailed research report for the AGM.

Summary of voting issues at this year’s AGM

The Minerva report highlights various issues and recommends voting against three of the resolutions and for two to ...

Post Date: April 4, 2024

Read more

NWG – Natwest Group plc Information and Vote Guidance 2023

ShareSoc introduced this new added value voting information service for Full Members only in 2021, providing background information on leading companies and AGM vote guidance. Initially, we are piloting this for FTSE30 companies, plus a few others in the FTSE100. We have decided to continue the pilot in 2023 and are looking at ways to improve our services to members.

Below are links to the:

1. Stockopedia summary report.

2. Minerva Vote recommendations for the 25 April 2023 AGM based on their standard template.

3. ...

Post Date: April 6, 2023

Read more

RBS Shareholder Committee Campaign – Update 17

ShareSoc and UKSA have now paused this campaign, because RBS are now engaging better with shareholders and have announced a programme of 4 events a year specifically focussed on engagement with individual shareholders. See https://investors.rbs.com/shareholder-centre/shareholder-events.aspx, where you can also access a recording of RBS' successful virtual event on 25 Nov 2019.

This has been a successful campaign. Notable achievements:

We were able to successfully requisition 3 resolutions at two AGMs.

Although we did not get shareholders to vote in favour of a ...

Post Date: December 15, 2019

Read more

RBS Virtual Shareholder Engagement Meeting 25 Nov 2019 at 7pm

RBS have now announced details of their Virtual Shareholder Engagement Meeting on 25 Nov 2019 at 7.00pm, when you can listen and watch on the internet and ask questions, from the comfort of your home or wherever you may be. I hope many members will attend this meeting.

To sign up and register click here

You will need to submit your shareholder number. It is on your shareholder certificate.

What happens if you hold your shares via a nominee? I have asked RBS to clarify if ...

Post Date: November 10, 2019

Read more

Law Commission Review of Intermediated Securities Consultation

I am writing to ask you to:

Send me examples and evidence we can use in our submission;

Consider making a personal submission yourself; and to

Update you on this important issue.

Submissions to The Law Commission Call for Evidence on the subject of dematerialisation, intermediated securities, shareholder rights and nominees/platforms must be made by 5 November.

The Law Commission “scoping” study will provide an accessible account of the law. It will also identify the corporate governance and other legal issues associated with ...

Post Date: October 22, 2019

Read more

RBS Shareholder Committee Campaign: Update 15

RBS Shareholder Committee Campaign: Update 15 - Resolution has been accepted and is on the AGM agenda

The Shareholders Circular and notice of the AGM was sent out on 18 March to all shareholders on the register, along with a copy of the annual report (only 267 pages this year), headed “Building a simple, safe and more customer-focused bank”. You only get a paper copy of the annual report if you asked for it.

Those people who have invested in RBS shares via ...

Post Date: April 9, 2019

Read more

RBS Executive Pensions row as Board fails again to listen to its shareholders

Press release 109 - RBS Executive Pensions row as Board fails again to listen to its shareholders

RBS has again failed to engage effectively with its shareholders, this time over Executive Pensions. As a result, the company finds itself yet again in the headlines, for the wrong reasons.

RBS Shareholders’ concerns about lack of effective engagement are vindicated by yet another escalating row.

ShareSoc and UKSA have requisitioned a resolution at the April 25th AGM to establish a Shareholder Committee, with the ...

Post Date: March 29, 2019

Read more

RBS AGM Vote Recommendations from ShareSoc

Many members have enquired about how they should vote their RBS shares. Our RBS AGM Vote recommendations are shown below:

Resolution 28. For. We have proposed this so clearly we support this resolution.

Resolution 2. Remuneration report. Against. Reasons.

CEO has pension of 35% salary. HSBC have reduced to 10%, so should Ross McEwan, RBS CEO. There is lots of press about this issue. RBS should listen to what is being said and act.

Male CEO has bigger pension allowance than female FD (35% v. ...

Post Date: March 26, 2019

Read more

VOTE FOR RBS AGM SPECIAL RESOLUTION 28 SHAREHOLDER COMMITTEE

RBS have now sent out the 2019 AGM circular to shareholders. This contains Resolution 28 requiring RBS to establish a Shareholder Committee, which was requisitioned by ShareSoc and UKSA members. If you own RBS shares, please vote for our resolution.

Sadly, the RBS Board will be voting against our resolution and have recommended shareholders to vote against it. Their rationale (which is full of spurious reasons and illogic) is as follows:

The concept of a shareholder committee was included in the Government’s Green ...

Post Date: March 22, 2019

Read more

Small shareholders renew bid to make RBS a better run company

Press release 108 - Small shareholders renew bid to make RBS a better run company

RBS Shareholders Requisition Shareholder Resolution for a Shareholder Committee.

Over 100 shareholders in the Royal Bank of Scotland (RBS) have requisitioned a resolution to install a "Shareholder Committee" at the company, which will include shareholder representatives, to improve the corporate governance and shareholder engagement at RBS.

RBS will now have to put this proposal to a vote at their Annual General Meeting (AGM) in May 2019.

ShareSoc ...

Post Date: December 18, 2018

Read more

ShareSoc-UKSA Resolution for the RBS 2019 AGM

ShareSoc has advocated the implementation of Shareholder Committees since our inception in 2011. ShareSoc has submitted resolutions to previous RBS AGMs requesting the implementation of an RBS Shareholder Committee. WE NOW NEED YOUR HELP WITH THIS YEAR'S CAMPAIGN

Please sign the correct form if you own RBS shares. You can find instructions for doing so here: https://www.sharesoc.org/rbs-agm-2019-requisition/

Or, if you don’t currently own RBS shares but wish to support our campaign, then we can give you 1 share and then you can sign the ...

Post Date: November 9, 2018

Read more

UKSA / ShareSoc policy papers, submissions and campaigns

Since we began merger discussions, UKSA and ShareSoc have worked together on policy and campaigning issues. Below is a list of issues where we have made a significant input. This shows the wide number of areas where we have been active since 1st January 2017 (Updated 25th October 2018).

Date

Document

Recipient

Drafted by

Notes

December 2018 (Started Dec 2016)

RBS Shareholder committee campaign

RBS/Media

ShareSoc (CW)

Supported by UKSA

November 2018

Procurement of Audit services

(Kingman Part II)

Sir John Kingman

PP with CW

Joint submission from UKSA and SS

October 2018

Competition and Markets Authority (CMA) consultation ...

Post Date: October 31, 2018

Read more

RBS AGM result and subsequent publicity

Paul Jackson wrote an in-depth analysis of the RBS Shareholder Committee campaign and the issues raised in the prestigious Investors Chronicle, 22 June 2018 issue, which is read by tens of thousands of investors. We are grateful to Paul and Investors Chronicle for giving us permission to reproduce this article. Click here: https://www.sharesoc.org/blog/shareholder-democracy/whose-company-is-it-anyway/

RBS AGM Result - Shareholder Committee Vote – We did well but it was a wasted opportunity

UKGI Votes were 75.3% of those cast. So their vote decided the outcome.

7.8% of ...

Post Date: July 14, 2018

Read more

Access to Placings for Individual Investors

The FT, 7 June, publishes ShareSoc and the UK Shareholders' Association joint letter about placings which exclude individual investors. We continue to urge all companies and their brokers and Nomads to allow individual shareholders to participate in placings.

The letter focussed on the recent placing by UKGI of RBS shares and was written by Cliff Weight and Peter Parry. It said:

It is a public disgrace that individual investors have been excluded from the placing by UK Government Investments Limited ("UKGI") of RBS ...

Post Date: June 9, 2018

Read more

RBS AGM Voting Recommendations, Remuneration and Campaign Update

ShareSoc recommend voting FOR the Shareholder Committee Resolution 27 and AGAINST Resolution 2, the Remuneration Report at the RBS AGM, which will be held on 30 May at 2pm in Edinburgh.

After two years of hard work, we are delighted to report that the RBS Board agreed to put our shareholder resolution for a Shareholder Committee on the AGM Agenda. The Shareholders Circular contains our item for discussion and resolution for a Shareholder Committee and the Board's Statement in response on pages ...

Post Date: April 29, 2018

Read more

RBS Confirms Shareholder Committee Resolution will be put to AGM Vote

Press Release 102 - Joint Press Release from UKSA and ShareSoc

RBS Confirms Shareholder Committee Resolution will be put to AGM Vote

* RBS has accepted our requisition of a Shareholder Resolution. There will be a debate and vote on the establishment of a shareholder committee at the May 2018 RBS AGM.

* Opportunity for RBS to lead UK plc in the first establishment of a formal shareholder committee. Sweden has 20+ years of positive experience with shareholder committees; lessons can be learned from ...

Post Date: March 19, 2018

Read more

RBS Shareholder Committee: We’ve (almost) won!

Great news from RBS! RBS have agreed to have our resolution put to the AGM.

UNFORTUNATELY, they will only agree to this, if the resolution is a SPECIAL Resolution rather than an ordinary one. That means that we will have to resubmit our requisitions for the special resolution.

So, if you own RBS shares, please complete the new Special Resolution Requisition form, which you can download from the ShareSoc website, click here.

Getting the shareholder resolution on the RBS AGM agenda is a huge ...

Post Date: February 14, 2018

Read more

RBS Campaign Update 10 – 161 forms submitted, press release issued and huge media coverage

Update 10 29/12/2017 - 161 forms submitted, press release issued and huge media coverage

Today I travelled to London to deliver the 161 signed forms to RBS. Yesterday, we issued a press release. Radio 4 reported on it in their Business Briefing at 6.25am. There were lots of press stories.

Cliff Weight Delivers Requisitions to RBS

We thought the press coverage today was balanced. We have worked well (together with RBS people) in avoiding the negative publicity that occurred earlier in the year. This is ...

Post Date: December 30, 2017

Read more

Small shareholders in bid to make RBS a better run company

Press Release 100 – RBS in the firing line as ShareSoc renews campaign

RBS Shareholders Requisition Shareholder Resolution for a Shareholder Committee.

Over 100 shareholders in the Royal Bank of Scotland (RBS) have requisitioned a resolution to install a "Shareholder Committee" at the company, which will include shareholder representatives, to improve the corporate governance and shareholder engagement at RBS.

RBS will now have to put this proposal to a vote at their Annual General Meeting (AGM) in May 2018.

ShareSoc ...

Post Date: December 30, 2017

Read more

RBS in the firing line as ShareSoc renews campaign

Press Release 99 – RBS in the firing line as ShareSoc renews campaign

Individual investors expected to join ShareSoc’s new requisition for a Shareholder Committee at the Royal Bank of Scotland

- As last year, ShareSoc will be requisitioning a resolution for a Shareholder Committee at the 2018 RBS AGM

- This year's resolution addresses the trivial legal objections previously raised by RBS. ShareSoc is confident that RBS will be obliged to put the resolution to the AGM

- ShareSoc is rallying ...

Post Date: December 5, 2017

Read more

ShareSoc Open Letter to the board of RBS Group

Press Release 98 – ShareSoc Open Letter to the board of RBS Group

For immediate release: ShareSoc has written an open letter to the Board of the RBS Group addressing unresolved issues that continue to concern individual shareholders.

Please see below and contact Cliff Weight on cliff.weight@sharesoc.org for more information.

SHARESOC OPEN LETTER

October 2017

TO THE BOARD OF RBS GROUP

Shareholder Resolutions for 2018 AGM

Since ShareSoc first engaged with you on 12 December 2016 there have been several positive developments which we recognise and ...

Post Date: October 25, 2017

Read more

RBS Shareholder Committee Campaign Update 5

This note has been issued to the campaign supporters.

Thank you for help and support so far. I am writing to update you on progress, which is very disappointing. I expect some of you will not read all of this long post and quite understand if you only read part: for those who wish to, I have included my full report on the RBS AGM below.

RBS refused to put our resolution on the AGM Agenda. Mark Northway, ShareSoc Chairman and Cliff Weight, ...

Post Date: June 16, 2017

Read more

Royal Bank of Scotland AGM Voting Recommendations from ShareSoc

PRESS RELEASE 93 11/04/2017

ShareSoc recommends voting against the following resolutions at the Annual General Meeting (AGM) of RBS: 2 Remuneration Policy, 3 Remuneration Report, 4 Chairman Howard Davies, 12 NED Penny Hughes and 24 General Meetings at 14 day notice.

RBS have continued to resist our request for a shareholders’ resolution to be put to the AGM for the establishment of a Shareholder Committee, and have steadfastly refused to share their legal opinion.

We consider the behaviour of the RBS board in ...

Post Date: April 11, 2017

Read more

RBS Rejects Democracy

PRESS RELEASE 87 01/02/2017

The Royal Bank of Scotland (RBS) has rejected a requisition to implement a Shareholder Committee.

ShareSoc will not permit this unreasonable obstruction of shareholder democracy to stand. It is a basic principle of Company Law that shareholders can requisition resolutions which must be put to a vote of shareholders. If the directors do not like a requisition, then they can advise shareholders to vote against it. But they should not be using tenuous technical excuses to avoid putting ...

Post Date: February 1, 2017

Read more

RBS Shareholders Demand Shareholder Committee

PRESS RELEASE 85 30/12/2016

A joint press release on behalf of Private Investors from ShareSoc & UKSA

Over 100 shareholders in the Royal Bank of Scotland (RBS), supported and coordinated by ShareSoc and UKSA, have requisitioned a resolution to install a new "Shareholder Committee" at the company which will include shareholder representatives so as to improve the corporate governance at the bank.

RBS will now have to put this proposal to a vote at their Annual General Meeting (AGM) in May 2017.

ShareSoc and UKSA ...

Post Date: December 30, 2016

Read more

ShareSoc and First Flight issue Recommended Code of Conduct for Non-Executive Directors

PRESS RELEASE 38 (7/11/2012)

The importance of having active and competent Non-Executive Directors (including Chairmen) in public companies cannot be over emphasised. They can make all the difference between the long term success or failure of a business, and are crucial when a company faces short term difficulties.

But many major corporate failures or near disasters such as RBS, BP, Northern Rock, AIG, Enron and more recently Olympus, News Corporation, Barclays etc have been assigned to an “inability of the Non-Execs to exercise influence ...

Post Date: November 7, 2012

Read more

RBS Report – Not a Total Whitewash, But….

PRESS RELEASE 15 (12/12/2011)

ShareSoc (the UK Individual Shareholders Society) welcomes the long overdue publication of the FSA report on the failure of the Royal Bank of Scotland (RBS).

It does highlight many important issues, and we have summarised those in an Appendix to this press release. For example, it suggests that existing regulations are not tough enough to ensure proper stewardship of banks and suggests some changes (the report sees no prospect of penalties being imposed on the directors of RBS). But ...

Post Date: December 12, 2011

Read more

Campaigns

Royal Bank of Scotland (RBS) Shareholder Committee Campaign

ShareSoc and UKSA have now paused this campaign because RBS are now engaging better with shareholders and have announced a programme of 4 events a year specifically focussed on engagement with individual shareholders. You can find further details here: RBS Shareholder Committee Campaign – Update 17

ShareSoc has advocated the implementation of Shareholder Committees since our inception in 2011. Recently this initiative has received support in the form of the Government's November 2016 Green Paper on Corporate Governance, and in the form of ...

Post Date: December 30, 2016

Read more

Corporate Remuneration Reports

RBS new Remuneration Policy 2017

I have written the following article which has been published in Executive Compensation Briefing Magazine. I could not resist giving RBS some muted praise for getting 96% approval for their new LTIP, whilst criticising them for their wimpish implementation, which just adds more complexity.

DRR of the Month - Royal Bank of Scotland

This month ECB editorial board member Cliff Weight comments on the new LTIP at RBS, previously reviewed in the March ECB .

The new RBS LTIP is epoch-making. The RBS approach ...

Post Date: May 17, 2017

Read more

Media Mentions

Reuters, 28 Nov 2019, Barclays Cuts CEO Pension Perks

Peter Parry comments on CEO pension payments: https://www.euronews.com/2019/11/28/barclays-joins-rivals-with-cuts-to-ceo-pension-perks

Post Date: November 28, 2019

Read more

CNBC, 25 Apr 2019 – RBS Bosses Braced for Shareholder Rebellion

https://www.cnbc.com/2019/04/25/rbs-bosses-braced-for-shareholder-rebellion-over-pay-report.html

“…The bank, which is still 62% owned by the taxpayer, has faced resistance from the Investment Association (IA), which has 200 members collectively managing over £7.7 trillion ($9.92 trillion) in assets, along with shareholder society ShareSoc and shareholder advisory body PIRC.

Earlier this month, ShareSoc director and RBS shareholder committee campaign co-ordinator Cliff Weight advised members holding RBS shares to vote against the bank’s remuneration report…”

Post Date: April 25, 2019

Read more

- EDUCATION

- MEMBERSHIP

Copyright © 2025 All rights reserved. Sharesoc® (UK Individual Shareholders Society). Terms of use and legal information (note this site uses cookies)

Digital Marketing by Chillibyte.

Digital Marketing by Chillibyte.