ShareSoc

INVESTOR ACADEMY

What is investing?

One of the founding fathers of modern investment principles, Ben Graham, offers a profound, but deceptively simple, definition of what constitutes an “investment”:

An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.

This superficially simple definition hides a number of subtleties. First, note that the definition applies to an “investment operation”, not to an individual investment. It is impossible to categorically identify one instrument as an “investment” and another as a “speculation”. Instead, it is the overall strategy that can be considered to be one of investment or speculation. Take a look at our Investing Basics series for further information about investment strategies – having one is essential to reliable success!

The second subtlety is the term “thorough analysis”: nothing can be considered an investment unless you have studied/researched it thoroughly and have a good understanding of the risks and rewards it offers. From Warren Buffett, Ben Graham’s pupil, and the world’s most successful investor.

Never invest in a business you cannot understand.

The same applies to investment products: if you can’t understand how they work or what the risks are – don’t invest.

Next “safety of principal”. There is no investment that can offer an absolutely cast iron guarantee that you will get your money back. About the closest you can get is a bank savings account, as long as you don’t invest more that the limit of the government backed FSCS. Even then, it is always possible (though highly unlikely) that the government could change the rules. Nevertheless, a sound investment strategy should minimise your risk of loss over the timeframe you envisage for it. As long as your portfolio of investments is well diversified, the risk of permanent loss can be kept low, over a sufficiently long timeframe.

And finally, “satisfactory return”. Just what is a satisfactory return? It is very much up to the individual investor to consider what constitutes a satisfactory return for them. It is important to be realistic, especially in an era of ultra-low interest rates – which amplifies the attractiveness of dividend paying shares, offering the prospect of a regular income and, if the underlying business does well, capital growth too.

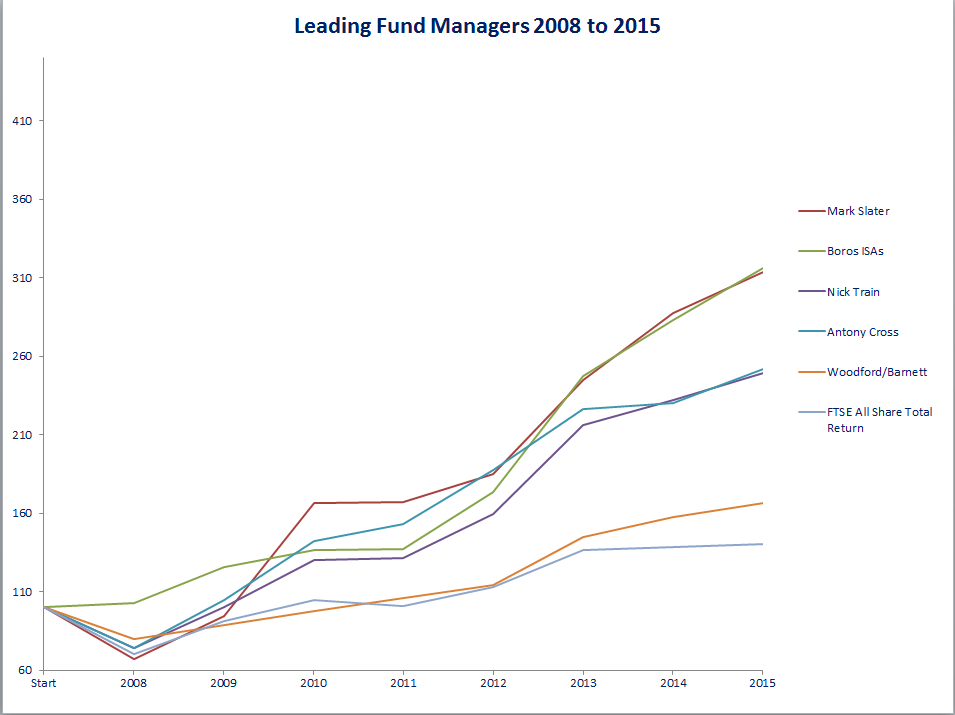

The following chart illustrates the returns achieved by some leading UK fund managers, in recent times:

The compound annual return of the best of these equates to around 16% p.a. – quite an achievement over an extended time period.