Blog from Cliff Weight, Director, ShareSoc. These are my personal views and not necessarily those of ShareSoc.

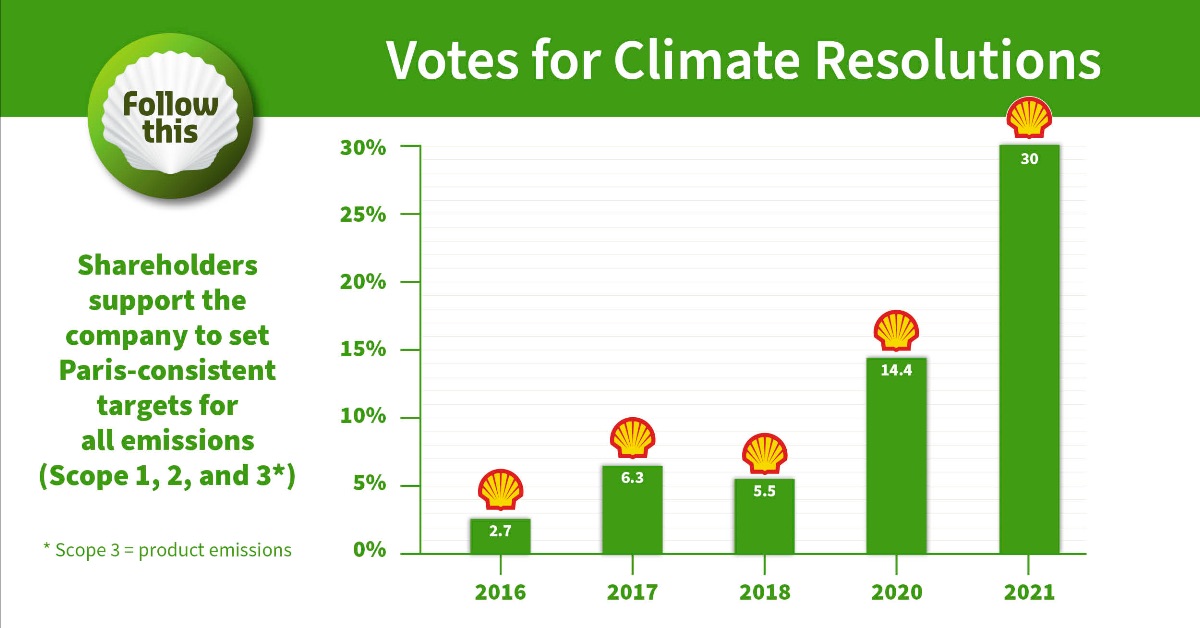

Support doubles to 30%, for the FollowThis! climate resolution at Shell AGM.

Shareholders tend to vote with Boards. Boards tend to be slow to react to shareholders views. The trend would suggest that the Shell Board now needs to change its stance, so that it moves its thinking alongside its shareholders and hence avoid a defeat in a future year.

This is clearly very important, I think. Without shareholder pressure, boards will not change their stance.

However, for shareholder pressure to be effective, shareholders must have the information they need to be able to hold boards to account. At present, much of the information that is presented is incomplete or seeks to put a ‘gloss’ on companies’ environmental performance that is often unjustified or misleading.

ShareSoc made a response to the recent BEIS consultation on mandatory climate change disclosure. We supported the thrust of the Government’s intent. We did however caution about the potential for greenwashing, partial disclosure, game playing by outsourcing and offshoring emissions in one’s supply chain, etc. On this occasion we were not able to submit a joint ShareSoc/UKSA response.

Just to be clear, UKSA didn’t object to mandatory disclosure of climate-related reporting in its submission to BEIS. What UKSA objected to was the way in which the government appears to be going about it. UKSA considers that the government has a penchant for ambitious targets and grand gestures, but often without any credible plan for their achievement. UKSA considers the haste with which the government is pushing the mandatory-reporting initiative through ahead of COP26 only adds to suspicions that it is being done primarily to put a tick in the box and score some Brownie points.

Apart from high level references to adopting the four pillars of the TCFD in climate-related reporting, the BEIS consultation gave little or no clarity on issues such as assurance of information; consistency, continuity and coherence of the measures against which companies would report; or on meaningful reporting on climate-related risks. These were all points on which we criticised the BEIS proposal in our feedback.

Both the ShareSoc and UKSA policy teams take climate matters very seriously. This being the case, we believe that, if climate-change reporting is to be of value, it must be done right. Serious initiatives on all aspects of climate control by governments or anyone else are welcome.

The FRC working party on the future of the AGM will continue to debate whether it is better to mandate a vote on climate change, whether to nudge Boards to put forward their resolution or to react only to shareholder resolutions. Peter Parry from UKSA and Cliff Weight of ShareSoc are on the FRC working party and will continue to put forward the views of individual investors.

We know that climate change is a contentious issue and for many raises strong views. We will read with interest comments on this post.

Such resolutions are about virtue signalling. The likely impact on climate change from actions by oil companies such as Shell is negligible while China continues to build coal fired power stations. Likewise cutting carbon emissions by building electric cars is pointless as the emissions from building such vehicles exceeds the benefit. Meanwhile the Government is intent on imposing massive costs on the public by aiming for zero emissions without any scientific justification or public consultation. It’s all bonkers.

How many private investors, who might be more rational, voted for these resolutions at Shell? Rather than institutions who were afraid to oppose?

Useful background data in this article. https://www.investmentweek.co.uk/news/4031729/greenwashing-tops-investors-concerns-esg?utm_medium=email&utm_content=&utm_campaign=IW.Daily_RL.EU.A.U&utm_source=IW.DCM.Editors_Updates&utm_term=W8%20REMUNERATION%20SERVICES%20LTD&uid=0f76a6cb92cf0bcf0d63a58986084c06

Greenwashing tops investors’ concerns around ESG

Investors also worry about higher fees and costs

Investors biggest worry is ESG products are not what they claim to be, with 44% citing greenwashing as their biggest concern when it comes to responsible investing.

This was closely followed by investors having concerns around these investments having higher fees and costs (42%) and if they will perform better than more traditional portfolios (38%), according to research from Quilter.

A member who prefers to remain anonymous has asked me to post her comment –

Agree that carbon pricing needs to include imported emissions – but that isn’t what the Shell resolution is about.

Roger misrepresents the motivation of institutional investors which generally is about value protection not virtue signalling.

A member who prefers to remain anonymous has asked me to post this comment –

I do think you need to look at this on an issue-specific basis to assess financial materiality. The strategic response of an oil/gas major to climate change is financially material. And it doesn’t follow that institutional investors want to do what NGOs want – they know that this won’t result in the pressure going away – it will just cause it to ratchet up – and so they need to justify what they do in relation to long term shareholder value. The institutional investors group on climate change (IIGCC) – as an example – is nearly 20 years old and in that time it has always been about the business case.

The example (of an institution that feels under the gaze of pressure groups and is guided by its own, well paid, governance committee might not protest if, for example, a company chose to give a director a £10,000 pay rise to be in charge of ESG matters, and that director proposed the company make a £1m donation to restore a wetland somewhere.) is unlikely to be an issue on which investors will engage – any more than they will engage on the specifics of £1m to any other cause – it is not material for the major companies that they engage with. They may/will engage on the underlying policy, eg. whether or not the company pours money into trade bodies that seek to advocate for a narrow interest that threatens the economy as a whole and hence the investor’s other holdings. Or regularly give money to “chairman’s pet issues” causes rather than those which align with the company’s long term interests. Or seek to undermine or distort regulation by political funding.

My issue with all of this is how a good idea becomes a job creation scheme for a certain type of person.

So the general cycle is: pressure groups suggest regulations are needed, non-elected groups such as PIRC come up with voting recommendations, institutions appoint people with flash titles to be in charge of “sustainability” with responsibility for carrying out “audits” and issuing “recommendations”, new board roles with additional remuneration are created at companies, and all the way along the line people create jobs where there were none before, all draining productivity from the economy.

As shareholders, we need to be very careful about initiatives which increase the costs for a company of doing business but do not help its productivity to improve. That is not to say these initiatives are wrong (although I note in yesterday’s Sunday Times Matthew Syed had some research showing that the organisations most vocal in their support of BLM have worse than average records on racial equality in the workplace), just that they are more likely to be in the interests of other stakeholders (directors, institutional investors) and non-stakeholders (NGOs) than shareholders.

An institution that feels under the gaze of pressure groups and is guided by its own, well paid, governance committee might not protest if, for example, a company chose to give a director a £10,000 pay rise to be in charge of ESG matters, and that director proposed the company make a £1m donation to restore a wetland somewhere. But there will be many investors who don’t feel the same way.

This is not to say that green initiatives are wrong. Just to note that for every £1 that ends up going to that initiative, the current modern form of crony capitalism will have paid multiples of that to “experts”, “consultants”, “committees” etc, none of whom have any accountability or exposure to the underlying company.

This culture may, by the way, partly explain the long term failure of the UK economy to improve its productivity: too many people talking about stuff, too few getting it done.