This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

by ShareSoc Director Cliff Weight. These are my views and not necessarily those of ShareSoc.

Readers may recall my blog in Oct 2020 about investment trusts discounts and what to do about them https://www.sharesoc.org/blog/collective-investments/investment-trust-discounts-what-to-do-about-them-and-sec-example/

On Friday 28 May 2021, SEC announced their new plan to help reduce their discount, https://www.londonstockexchange.com/news-article/SEC/contingent-tender-offers/14995537 :

2022 Contingent Tender

The Board has determined to put in place a contingent tender offer in 2022, should the ordinary shares trade at a wider than average discount of 8 per cent. over the 12 months ending 30 June 2022. In this event, the Board will undertake a tender offer for up to 10 per cent. of the Company’s issued share capital (excluding shares held in treasury) shortly after the 2022 AGM (the “2022 Tender Offer”). The tender price will be equal to a 3 per cent. discount to NAV (less costs) per ordinary share. In the event that shareholders tender in excess of their basic entitlement of 10 per cent., such excess applications will be satisfied on a pro rata basis to the extent that other shareholders tender less than (or none of) their basic entitlement.

2024 Contingent Tender

In addition to the 2022 Tender Offer, the Board has resolved to undertake a further tender offer if, over the three year period ending 30 June 2024, the NAV total return per ordinary share lags the FTSE Small Cap (ex Investment Companies) Index on a total return basis (the “2024 Tender Offer”).

In the event that the 2024 Tender Offer is triggered, the Board will undertake a tender offer for up to 15 per cent. of the issued share capital of the Company (excluding shares held in treasury) shortly after the 2024 AGM at a tender price equal to a 3 per cent. discount to NAV (less costs) per ordinary share. In the event that shareholders tender in excess of their basic entitlement of 15 per cent., such excess applications will be satisfied on a pro rata basis to the extent that other shareholders tender less than (or none of) their basic entitlement.

This follows significant pressure from shareholders and ShareSoc.

This tender offer looks a really good idea. Do we agree and should we be advising other investment trusts with discounts to consider a similar mechanism?

The timescale is interesting. It gives management a chance to turn things around. The share price went up 2.35% on Friday 28th, which is a positive sign. I am told that quite a few of the bigger investors have now sold and there has been quite a turnover of the register, so where the share price and discount will settle is not yet clear.

The averaging period of 12 months to 30 June 2022 is also interesting. The current discount is 13.4 per cent. (as at 26 May 2021, the latest available NAV calculation date), so if the a linear trend down were to occur the discount would have to fall to just under 3% by 30 June 2022 to average at 8%. I think this is a tough target and it is admirable that the board have set such a tough target.

What might happen next?

If the discount narrows to less than 8% (averaged), then there will be no 2022 tender offer and the fund manager will receive their fees on the whole of the fund. The Board will celebrate the success of their discount strategy and dissident shareholders will either shut up or sell up and go away.

I suspect that if the discount continues then all shareholders will seize the chance to sell 10% of their holdings at a 3% discount and that tenders will be scaled back. However it might allow SEC to get rid of some troublesome shareholders at not too expensive a price for the other shareholders to have to subsidise. The fund manager will have a smaller fund to manage and receive less fees (however the fund NAV has grown by quite a lot over the past 6 months so this would more than compensate the fund manager, who would still be receiving larger fees than in the past).

I spoke to the Chairman today and he explained that they have changed their fund manager, administrator and auditor and were now confident for the future.

The tender offer looks like the key shareholders have agreed to let the Board pursue its strategy until at least 2024.

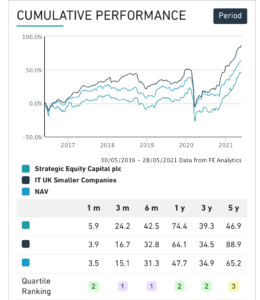

With a new manager (Ken Wotton at Gresham) and a focus in UK small caps (what I regard as a good place to be), the outlook is interesting and the performance over the past months, 1 year and 3 years is excellent.

The directors still have very little skin in the game (i.e own few shares). If they bought more, this would be a sign of their confidence in their strategy.

Should other investment trusts follow this example?

I think any investments trust with a discount will need to seriously look at this case study.

My October 2020 blog highlighted a range of ways to reduce the discount. Tender offers are not the only way, but appear to be a powerful tool in the armoury. A combination of shareholder pressure and an enlightened board willing to embrace new ideas seems to me to be the best approach.

Conclusion

The SEC case study is a good example of what shareholders can do, if they engage pro-actively with management who are also willing to engage. There have been shareholder resolutions and various parties have put their views forward strongly. The progress so far looks positive, but time will tell whether today’s rosy outlook is justified.

Disclaimer: I own shares in SEC and Gresham House.

7 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

I’m wary of tender offers as a mechanism for reducing an investment trust discount.

Increasing the share price (by reducing the discount) is a short-term fix that mainly benefits those wishing to get rid of their holding quickly. If the underlying cause of the discount – an unpopular sector, poor performance or low investor awareness of the trust – isn’t addressed, the discount will return.

Of course, a returning discount can be addressed by holding repeated tender offers, but each time that happens the size of the fund is reduced, increasing the company’s relative expenses each year. If the trust is not very large in the first place, this can have a significant impact. Unlike a low discount, which can vanish and leave no residual benefit for the remaining shareholders, this year’s higher expenses are money lost and gone forever: a 0.2% increased annual cost permanently reduces the net asset value of the trust by 0.2% each year, and that impact accumulates over time.

There is a compensating, marginal benefit to the remaining shareholders if the tender is conducted at a modest discount, marginally increasing the net asset value per share. But a share buyback program conducted at a much higher discount that reflects the prevailing market price creates far more of an NAV uplift. As a long-term shareholder, that is always my preferred option.

Sometimes, reducing the trust’s size is actually beneficial; a trust can actually be too large and cumbersome to invest in its target market, especially where that target market is smaller or less liquid companies. However, even in this scenario a rolling buyback program may be more beneficial to long-term shareholders, not only reducing the trust’s size but also increasing the NAV far more than a tender will do.

I concur with Toby’s comments. If there is a large discount, I would prefer to see the investment trust buying shares in the market rather than via a tender offer at a price which is higher than the market price while being lower than NAV.

The discount is the result of inadequate demand . The discount control mechanism is one tool to use .

The board has now recognised that dropping an earlier commitment to control the discount damaged shareholder interests. Now it must put pressure on the manager to market the trust effectively and stimulate new demand of sufficient size to take out the arbs who now control the share register.

I cannot see the arrangement with Standard Life Aberdeen doing this as the trust is too small to capture the attention of the sales force and investors in trusts like thus want to eyeball the manager .

I confess that I’ve only now seen Cliff’s earlier piece, which gives an impressive summary of SEC’s history with buybacks, tenders and arbitrageurs as well as offering a very useful table of possible causes of discount and actions that can be taken.

Tenders and buybacks are clearly not the only options, and neither are appropriate if the trust is already too small.

Historically, SEC arranged tenders at a 10% discount to NAV, which will have resulted in a significant uplift in NAV for remaining shareholders even if it did not fully reflect the market discount at the time. After making no buybacks or tenders at all during calendar year 2020, it’s now offering a tender at a 3% discount, despite the shares trading (today) at a 12.7% discount.

I’m another one who doesn’t like tender offers. As a buy-and-hold investor I’m not that bothered about discounts anyway, potentially it gives me the chance to buy more at a discount. If something caused me to want to sell I’d just sell, waiting for some hypothetical discount narrowing is unlikely to be worthwhile.

If there is a tender it’s a pain, if I don’t take it up it seems foolish given that I can (probably) buy back at a lower price, but it’s a lot of effort for what may just be a 5% turn on 10% of my holding. Obviously there are dealing costs to repurchase which are disproportionate for a comparatively small amount.

Finally there’s the whole question of what it takes to participate. In a nominee account the broker may not even inform you, never mind making it easy to take up. With certificated holdings I think it’s even worse – find your certificates, tender them, and usually (for no reason I can discern!) get someone to witness your signature on the document.

Bottom line, I’d much rather have an aggressive buyback policy – I see lots of trusts which regularly ask for a buyback authority but in practice only buy a tiny amount. A constant buyback at say a 5% discount is much more likely to be effective than a possibility of a 10% tender every three years; if it doesn’t work it probably means the shares are just very illiquid and nothing much will help.

Discounts to NAV can be a good thing if I buy at a big discount and the discount either remains constant or narrows.

If I buy at a 15% discount, then that’s equivalent to almost 18% gearing, but with no borrowing required !

The only time discounts are a problem is if the discount widens and I want to sell.

In principle, I’m against the concept of Investment Trusts shrinking themselves via discount control mechanisms, or paying out a percentage of NAV as dividends. I’d rather have the opportunity to buy at a discount AND see the trust maintain a large size, so fixed costs can be spread over more shares.

Of course about 80% of trusts were at a discount last time I looked, including some with good long term track records. Another side effect of this is that it only seems possible for well known fund managers or those in fashionable sectors to get a new Investment Trust launch completed. After all why buy at launch with no discount, when sooner or later it is likely to be available at a discount ?

I asked the AIC for their view and they replied with this quote:

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC) said: “Looking at the investment company industry, 15% of companies (43 by number) now have a tender offer which is triggered by a widening discount.

“It’s important to understand the terms of the tender offer as they can be triggered for different reasons. For example, some investment companies activate tender offers when they do not meet a specific performance benchmark whereas others are activated by either the discount widening or a performance target not being met.

“There are 28 investment companies which offer regular tender offers to shareholders. Again, the terms vary, with some investment companies offering a quarterly tender every year whereas others may offer a tender offer every seven years.”