This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

I am quite keen on the potential of fracking in the UK and own some shares in Egdon. The USA has seen its economy transformed, as it moved very quickly to adopt this new technology and once again has become self sufficient in oil. Sadly (for me), the UK government has been slow to see the economic benefits of fracking and my investment in Egdon has languished. The company has just launched a £2m open offer to finance its next stages of development.

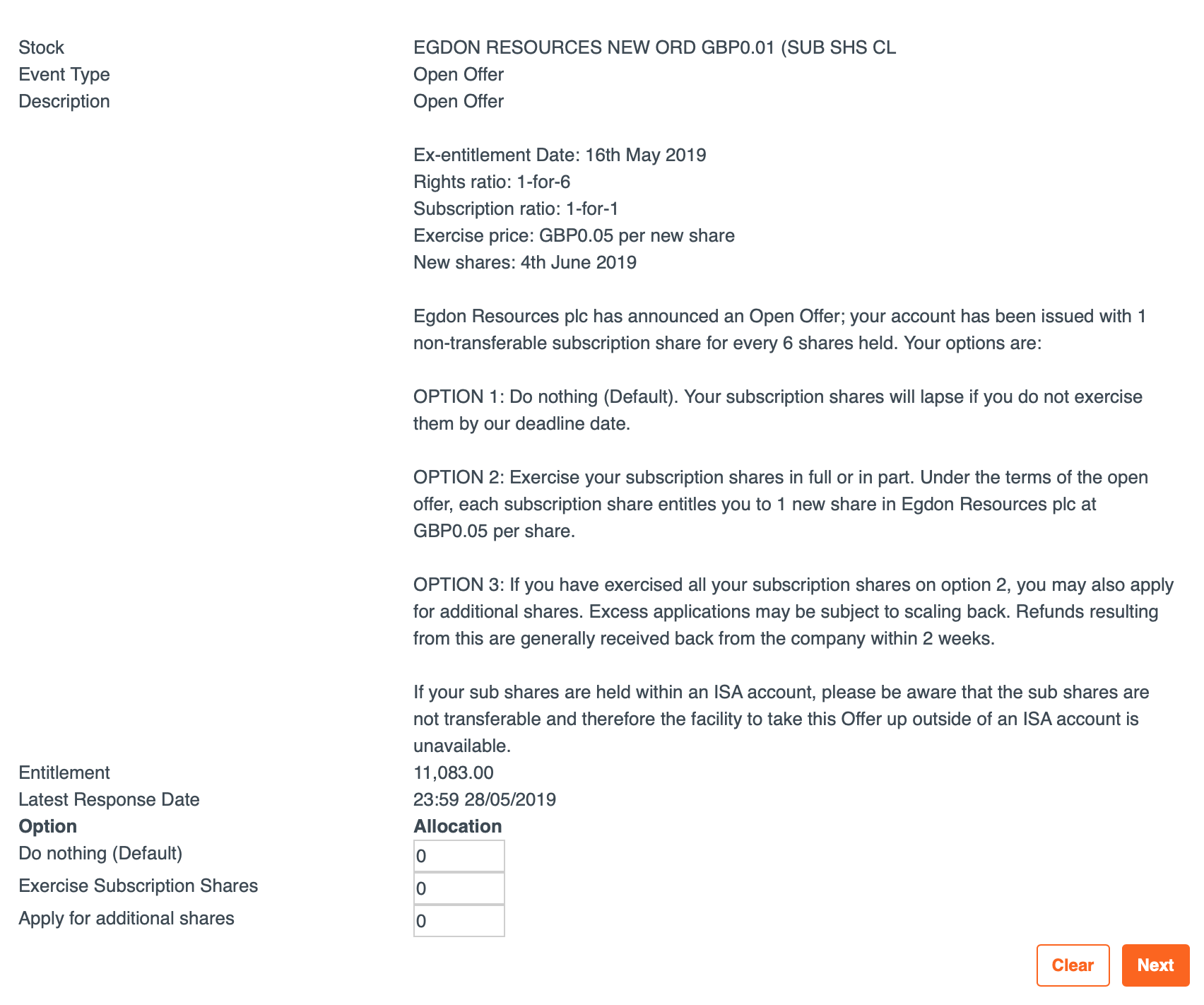

So, I am left with the choice. Shall I throw more good money after bad, or shall hold on to my now much reduced investment or shall I sell the lot? With an open offer there is no option to sell the rights in the market. Interactive investor have told me my options:

There is a fundamental difference between a rights issue and an open offer, and Egdon has gone for the latter (“real” rights issues are unusual for micro-caps like Egdon, as they are much more costly and complex than an open offer, and are generally underwritten by investment banks, who wouldn’t touch micro-caps).

In a rights issue, the “rights” issued to shareholders are usually tradeable instruments, which can be bought or sold on the market and have an intrinsic value as a result. Given that rights are invariably exerciseable at a discount to the pre-rights share price, they can be valued in the same manner as a traded option (using the Black-Scholes model). Assuming that the rights can still be exercised at a price below the prevailing share price when they must be taken up, they can be sold in the market to other traders willing to take them up.

Unlike “rights” which are tradeable, the “subscription shares” are a concept invented by my broker. There is no mention of them in Egdon’s documentation. Rights to take up the open offer are not transferable, are personal to the shareholder, and hence have no market value.

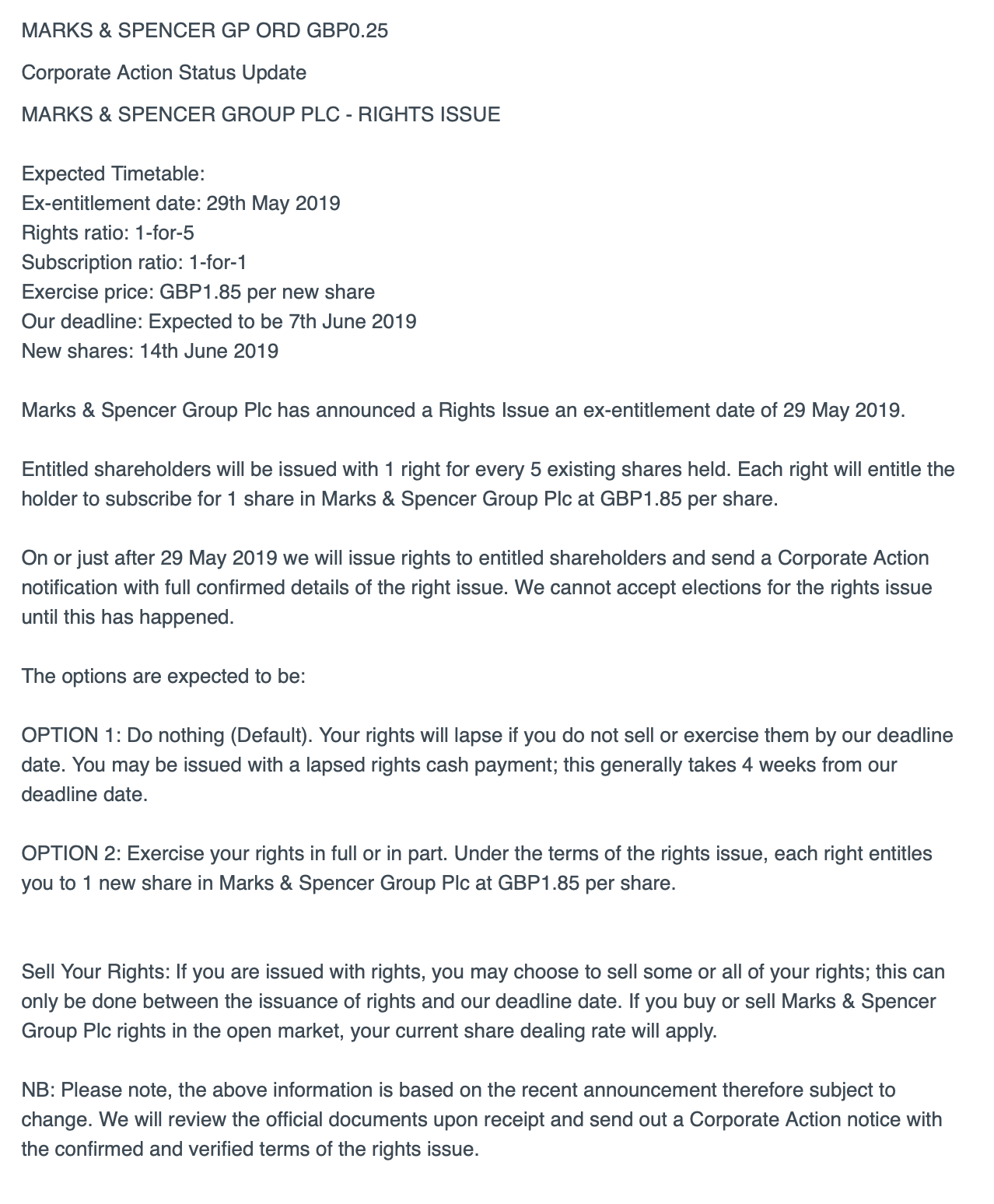

Another case is Marks and Spencer.

This is a 1 for 5 rights issue at a discount of about 32%.

By contrast to Egdon, the Marks and Spencer offer is a “real” rights issue . The prospectus setting out the full terms has been published: https://corporate.marksandspencer.com/?pointerid=5ce7b7107880b21d943ebe32 . The “nil paid” shares (the rights) will be issued to shareholders and become tradeable on 29th May. Note this point on p112 (which is standard for rights issues as opposed to open offers):

“If you do not want to take up your rights, you do not need to do anything. If you do not return your Provisional Allotment Letter or Share Service Form of Instruction subscribing for the New Ordinary Shares to which you are entitled by 11.00 a.m. on 12 June 2019, the Company has made arrangements under which the Underwriters will try to find investors to take up your rights and the rights of others who have not taken them up. If the Underwriters find investors who agree to pay a premium above the Rights Issue Price and the related expenses of procuring those investors (including any applicable brokerage and commissions and amounts in respect of irrecoverable VAT), you will be paid for your share of the amount of that premium, so long as the amount in question is at least £1.85, except Qualifying Share Service Shareholders who will be paid regardless of the value, in pounds sterling by BACS payment to the mandated bank account registered with Equiniti Limited for the payment of dividends.”

Note also that interactive investor advises that you have the option to sell your M&S rights, which is not the case for the Edgon as the open offer subscription rights are not tradeable or transferable.

It is also important to note that the value of M&S shares “cum rights” (i.e. before 29th May) will be higher than when they go ex-rights, because shares purchased after the XR date do not receive the rights and hence lose the value associated with the rights. (in a similar way to the reduction in value of a share when it goes XD).

M&S has c. 190,000 private shareholders; plus probably a similar number who hold their shares via nominees but are not counted by M&S in their figures for the number of shareholders. Commendably, M&S wrote to ShareSoc and UKSA and asked us if we had any suggestions and comments on their planned approach. I told them to do a S793 request to the platforms to identify the real numbers of shareholders they have.

They pointed out that typical private investor participation in rights issues was 40% for those who held their shares directly (i.e. in paper certificate or via Personal Crest Accounts) but closer to 90% for those who held via nominee. They wanted as many as possible of their shareholders to participate and have:

- Worked closely with their registrar Equiniti to develop an end to end process to enable shareholders to participate online, which they say is an industry first;

- Negotiated a reduced dealing commission of 1.5% with Equiniti, in place of their normal flat fee of £15 which might have deterred some small shareholders;

- Held two additional meetings of their shareholder panel; and

- Launched a dedicated webpage/site https://corporate.marksandspencer.com/investors/shareholder, which includes this useful guide to what is a rights issue https://corporate.marksandspencer.com/documents/rights_issue_190508.pdf

Interactive Investor sent me notification of the rights issue and the info below:

It is not clear, from the ii website, that if you do nothing, whether you will or will not get a payment. It says you “may” do and I think this is a legal caveat because of issues around different countries. Whether rights holders that do not exercise get a payout or not, and how much, will also depend on the price of the ordinary shares at the exercise date. One would expect the value of each right to be approximately the difference between the exercise price and the share price at that date. I think UK private shareholders will get the payment if they do nothing. As noted above p112 of the prospectus explains what will happen. But please don’t be guided by my view. I am not authorised to give advice.

Should I take up the M&S rights?

My usual approach to big rights issues is to wait until the very last moment and then decide. Many of the big players have to decide earlier in the process.

With deep discounted rights, I tend to feel I have to take up the rights, as otherwise others will profit at my expense.

I sometimes sell the rights in the market, but feel this is second best.

I know that if I do nothing then I am giving value away to those who do take up the rights issue. But sometimes when the company is looking pretty terminal then I do not want to invest more of my good money after what has become a bad investment.

A key issue is to consider the rights issue as an investment. Is this the best opportunity for the use of your available investment funds?

Ben Rogoff at Mello this month said the retail sector will be full of losers as Amazon will dominate (this does not mean that Amazon will be a good investment, but he thinks many of the others will be awful). M&S is doubly challenged as it is in decline since the mid 1990s – the decline started in the last couple of years of the reign of Sir Richard Greenbury.

Dividends and Rights Issues

M&S paid out £600 million in dividends in 2017 and 2018. They now need a £600 million rights issue. As individual investors, we would view this as imprudent, a reckless and risky approach to corporate finance. It attracts the wrong sort of investors onto the share register. It creates a volatile share price. Long term investors favour a more conservative approach to only pay dividends that are sustainable.

Another key issue is that it is not good for shareholders, for a company to pay out dividends on which the shareholders get taxed and then ask for it all back again by way of a rights issue (which now has to be taken up using taxed income).

The AGM at Wembley on July 9 should be fun!

Please note I am not qualified to offer financial advice and you should not rely on my opinions. I do own shares in M&S.

Cliff Weight, Director, ShareSoc

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.