Link Scheme Voting Considerations

URGENT: ACTION REQUIRED: VOTE NOW

THE “SCHEME” – WOODFORD EQUITY INCOME FUND COMPENSATION

The FCA has agreed a compensation approach using a Scheme of Arrangement which must now be voted on and approved by Creditors (relevant investors in Woodford Equity Income Fund). If approved, the Scheme must then be sanctioned by the High Court. The Scheme has been devised as a mechanism for Link to reach a final settlement with ALL WEIF Investors, regardless of whether they are involved in a legal claim.

What do you need to do? Vote!

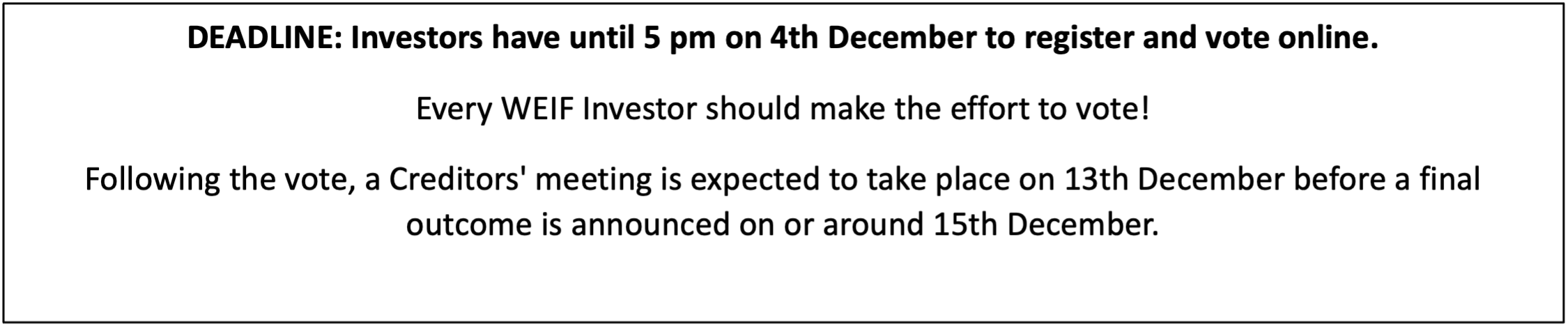

The Scheme requires the support of 75% of voting Creditors by value, and 50% by number. Large Institutional investors also only have one vote each.

To vote, each Creditor must prove that he/she owns WEIF shares. You need to have the relevant information, usually obtainable from your broker/platform intermediary. Hargreaves Lansdown, for example, has sent the relevant information to each investor via its Secure Messaging Portal.

- Note: Some investors may be unsure how many shares they hold and whether they sold shares since Suspension (unlikely, since it was suspended). Please Note: Fund distribution payouts and share sales are two different things. Fund distribution payouts do not change the number of fund units that an investor holds. However, share sales do reduce the number of fund units that an investor holds.

The online voting portal is the preferred mechanism for voting.

Online Voting Portal

Anyone wishing to attend the meeting in person should contact the Link helpline on 020 3991 0224. For anyone with problems voting via the online portal, the site also contains a 22 page printable voting form.

The FCA recently published an explanatory Update (Friday 10 Nov 2023) that summarises the situation and their view. It is easier to understand than the main Scheme website from Link – see: FCA Update: Woodford Equity Income Fund redress | FCA

The main website detailing the Link Scheme of Arrangement and providing relevant documents is at: https://lfwoodfordfundscheme.com/. The key documents include:

- Letter to Investors

- Explanatory Statement

- FCA Investigation Summary and the FCA Redress Calculation

- Report of the Chair of the Investors’ Committee

ShareSoc’s views on the Scheme:

1. Quantum

ShareSoc considers the amount of compensation proposed under the Scheme compensation to be clearly insufficient:

a. The FCA’s estimate of the loss suffered by investors as a result of regulatory misconduct (£298 million) is, in ShareSoc’s view, substantially too low. The methodology used by the FCA relates solely to unequal treatment of investors during a short and arbitrary period prior to suspension. This methodology assumes that mismanagement of liquidity and fundamental deviation from mandate do not constitute regulatory misconduct. We disagree.

b. The period used by the FCA for its estimate of loss runs from 1st November 2018, whereas liquidity rule breaches were identified as early as 1st July 2018.

c. Multiple parties, including the legal claims, have estimated the loss to investors at over £1bn.

d. Of the £230 million headline redress under the Scheme, only £180m will be paid out in mid 2024, with the remaining £50 million reserved to cover costs and to defend other potential legal actions. There is no guarantee that Creditors will eventually receive any part of that £50 million.

e. The Scheme does not provide any compensation for investment returns or interest forgone, although the harm occurred more than four years ago.

2. The Financial Services Compensation Scheme (FSCS) is avoiding its obligations.

Why isn’t the Financial Services Compensation Scheme (FSCS) covering the gap between Scheme redress (up to £230 million) and losses identified by the FCA (£298 million)?

a. The FCA has identified regulatory harm in the amount of £298 million (which ShareSoc already believes to be derisory).

b. In the normal course of events, the FCA should issue to Link Fund Solutions a Restitution Order on behalf of affected investors in the amount of £298 million. Such order would undoubtedly be challenged, and the outcome of such challenge cannot be certain, although after four years of investigation it can be assumed that the FCA’s accusations are based in fact.

c. If the order were upheld, then in the very likely event that Link Fund Solutions Limited became insolvent before fully complying with the order, the remaining payment obligation should be covered by the FSCS.

d. The FSCS covers up to £85,000 of an investor’s relevant losses in the event of the liable party being unable to pay.

e. Despite the existence of these protections, the proposed scheme only covers between 60% and 77% of the harm identified by the FCA.

f. No recent output from the FCA suggests that the regulator’s scrutiny of other involved parties is likely to benefit affected investors.

g. In ShareSoc’s view, the proposed scheme therefore protects the FSCS (and therefore the industry levy through which it is funded) at the direct expense of the affected investors.

h. This sets a dangerous precedent, and risks undermining confidence in the UK financial services industry.

3. No further redress

If the Scheme is approved, the way it has been written closes off all avenues for legal claims against Link by Scheme Creditors.

a. None of the existing legal redress claims will be able to proceed, except where the claimant redeemed prior to the suspension date.

b. The scheme blocks paths to financial restitution via the FSCS and the Financial Ombudsman.

c. The settlement binds all investors in Woodford Equity Income Fund at the date of suspension, even if they do not vote on the Scheme.

4. Inadequate information

a. What might happen if the Scheme doesn’t go ahead is a key consideration for WEIF investors. Link’s explanation (endorsed by the FCA) is very negative and only outlines one potential set of outcomes. It fails to mention or explore some potential alternative outcomes, such as a claim on the FSCS or an award through the Financial Ombudsman Service (FOS), or a claim on Woodford Investment Management, Northern Trust, Hargreaves, Quilter, etc.

b. Awareness by affected WEIF investors is very low. This is due to a range of factors, including communications that appear complex and unbalanced to us, as well as some platforms failing to pass on communications from Link to potential voters.

In summary, ShareSoc’s view is that the proposed redress under the Scheme is both inadequate and unfair. It is the role of the FSCS and FOS to protect individual private investors, and the Scheme effectively dilutes those protections.

Which Way should Creditors vote?

Investors will ultimately need to vote according to their own individual circumstances and preferences.

Key Questions

- Does the proposed Scheme provide full and fair compensation for investors?

- Is the FCA’s calculation of investor harm (losses) reasonable?

- Are alternative routes to compensation (including FSCS) likely to produce better outcomes?

- Will there be any additional avenues available to top-up the compensation (such as Hargreaves Lansdown, Woodford Investment Management, Northern Trust)?

- What happens to current legal claims (Leigh Day, Harcus Parker etc).

- Is the Scheme structure and process right, proper and fair?

- How does the Scheme affect different cohorts of investors?

ShareSoc expects that individual Creditors holding direct claims (WEIF Investors at the time of Suspension) will fall broadly into three categories:

- Substantial Creditors holding shares with a NAV (Net Asset Value) exceeding, approximately, £1.3 million at the point of suspension. These investors are likely to achieve a better outcome from the Scheme than through alternative routes targeting Link, since the latter are likely to be subject to the FSCS compensation limit of £85,000 per person.

- Smaller Creditors who ARE NOT currently involved in a legal claim. These investors will need to weigh the certainty of an inadequate payout under the scheme against the delay and uncertainty of waiting for what they deserve. If the Scheme is voted down, the FCA should, at the very least, proceed with a Restitution Order in the amount of £298 million which may offer a better outcome than the Scheme.

- Smaller investors who ARE currently involved in a Legal Claim. (Note: These investors are contractually obliged to pay a portion of any recovery to the relevant claim management company). The various law firms are targeting substantially higher redress than is offered under the Scheme, but there is of course litigation risk associated with the claims. Again, if the Scheme is voted down, the FCA should, at the very least, proceed with a Restitution Order in the amount of £298 million which may offer a better outcome than the Scheme.

These generic considerations will, in many cases, be secondary in investors’ decisions to the benefit of receiving an element of guaranteed payment in the short term, and to the psychological benefit of drawing this fiasco to a close.

Views of Others:

ShareSoc has been informed that all of the law firms who filed legal claims against Link are highly critical of the Scheme and the circumstances leading to it. They have written to their clients directly. We have been given to understand that 2 of the 3 have either recommended voting Against the Scheme of Arrangement (Harcus Parker), or in RGL’s case evaluated the Scheme in a manner likely to lead most investors to conclude they should vote against, with certain exceptions. RGL has also stated its claim against Hargreaves will likely continue even if the Link Scheme is approved. Leigh Day’s communications on the scheme are privileged for its clients only, so ShareSoc cannot comment on the firm’s position.

ShareSoc

16th November 2023

Disclaimer: ShareSoc is not a regulated entity and does not provide financial or legal advice. Nothing in this document should be treated as advice, and Creditors must reach their own conclusions based on the facts.

Please note that if you are not already a Full member, there is a special discount available for anyone signing up as a Full member of ShareSoc: Woodford Campaign Member Special Offer – ShareSoc. Full members also have access to Woodford Campaign Blogs and private Facebook Woodford Campaign Groups

3 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

Hargreaves Lansdown did add a message in my online ‘Secure Messaging Portal’. However, they did not send me an email to tell me that I had a new secure message (which they normally do). So I only found out by checking my HL online account. I suspect there are some HL customers that are blissfully unaware that they have the voting details. Is this deliberate to reduce voting numbers?

HL emailed me and their online message made it easy to vote.

Leigh Day have recommended a vote for – 2 Zoom meetings with the class action participants are planned for next week which may enlighten us why they are doing so – contrary to the other 2 class actions. I’ve not been convinced by their stated rationale for a vote in favour of the motion