Woodford Campaign Update 10

Group Litigation Order Hearing

The Group Litigation Order (GLO) request was heard in court between 15th and 20th December. The request was a joint submission by Leigh Day and Harcus Parker, with a subsequent request from RGL to be included.

Surprisingly, the judge decided against granting a GLO, favouring instead bespoke case management by the court, as requested by the defendant, Link. This means that there won’t be any imminent deadline for registering with a claim.

The claims will still be run on a group basis for all claimants of Leigh Day and Harcus Parker. The judge has set deadlines for these law firms to press ahead with pleadings, with Link’s Defence due in May 2023.

Investors who join a legal claim will see a deduction of approximately 30% (LD), 25% (RGL) or 42% (HP) from the value of any successful claim, in accordance with their litigation management agreement.

ShareSoc continues to endorse the Leigh Day claim of WEIF investors against Link, and receives a retainer from Leigh Day to support the campaign, for providing the Campaign Forum and other advice / assistance.

Financial Conduct Authority

The FCA’s proposed £50 million fine of Link and £306 million redress scheme have added considerable complexity for affected investors.

It is not clear at this stage whether the FCA scheme will proceed, what criteria might be used for determining investors’ eligibility to claim redress under such scheme, or the mechanism for determining loss.

It is also unclear whether partial compensation under the FCA scheme (which is significantly smaller than the potential private redress claims) will be conditional on claimants accepting any payment as full and final settlement.

Financial Ombudsman Service

ShareSoc recently met with the FOS.

The FOS represents a potential way forward for the estimated 160,000 individuals who invested in WEIF via Hargreaves Lansdown’s MMFs (Multi Manager Funds). It is looking unlikely that a properly funded group legal claim will emerge covering these victims, and Hargreaves Lansdown has so far shown no interest in making a claim on behalf of its MMF investors against Link.

These are very large numbers and will be challenging for the FOS as this would be an unusually large workload for them, if the issue got momentum.

The FOS Process:

FOS reviews individual claims (or groups of similar claims). If it upholds the claim, then the expectation is that the affected firm (and other firms in a similar situation) will respect the precedent and offer settlement accordingly.

The first step is for the claimant to approach the relevant party/ies (Link, Woodford, Hargreaves, financial advisers depending on the specifics) and for the party/ies to respond; then, if not satisfied, the claimant can refer the matter to the FOS, who will review the claim.

Current FOS situation

The FOS has about 500 outstanding WEIF direct investor claims, some of which were filed a considerable time ago. These break down into:

• Claims against IFAs (suitability, poor advice). The Ombudsman has reportedly resolved about 100 of these. We searched but cannot find a list of them or information on individual outcomes.

• Claims against HL and / or Link. These form the bulk of the caseload. It is unclear when these will be resolved.

• Claims from HL advised clients, where investments in Woodford WEIF and MMF were recommended.

Many consumers who make FOS claims are not clear about exactly what they are complaining about. The FOS has an inquisitorial remit, so potentially can investigate quite broadly.

A FOS claim may be attractive, especially for MMF investors. There is no cost associated with a FOS claim; but there is no guarantee that FOS will rule in an individual claimant’s favour or deliver the entire value of the claim.

A complex decision process

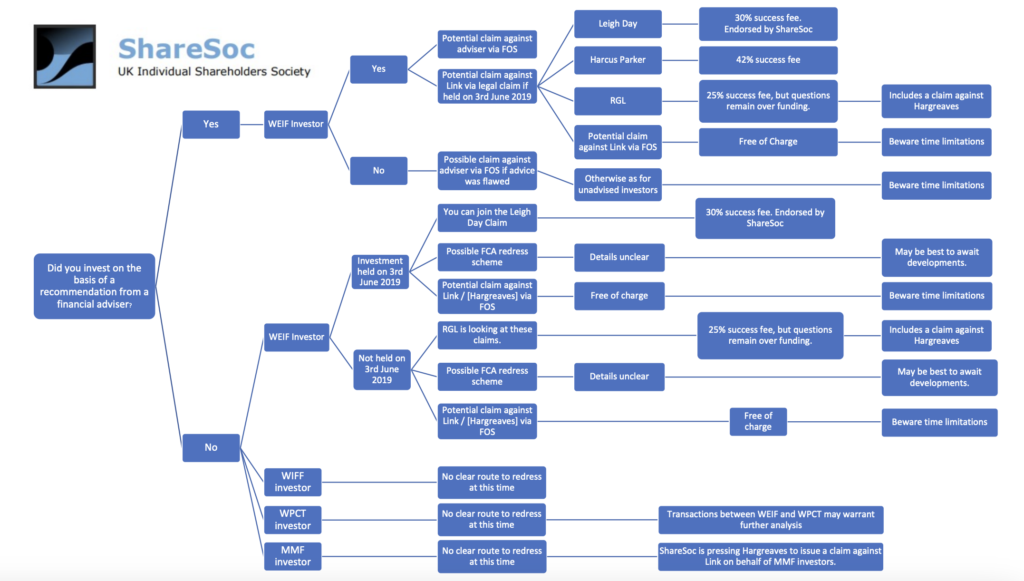

The multiple claim routes and the uncertainties surrounding each make for a difficult decision process for affected investors, which needs to take account of their individual circumstances.

ShareSoc has prepared a decision tree (click here to view), based on its current understanding of the situations. Potential claimants may find this of interest and helpful in considering their own decisions.

Next steps

There is an argument that those who have not yet acted should sit tight for now and watch the development of the various redress routes. But it is critical not to miss a deadline, so all potential claimants should be signed up to relevant forums / newsletters / Facebook groups and should keep a weather eye on progress.

ShareSoc will continue to provide updates to investors registered with our Woodford Campaign.

This document is issued for information purposes. It sets out our understanding of the situation and our opinions, but we accept no liability for errors or omissions. Nothing herein constitutes legal or financial advice.

Cliff Weight

ShareSoc Director and Woodford Campaign Director

11th January 2023

2 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

Could I add a few caveats to the above report:

It may not be accurate to say “This means that there won’t be any imminent deadline for registering with a claim”. It does depend on what one understands by the word imminent! There are potential limitation deadlines, and we do not know how long lawyers will continue to take further claimant sign ups, in light of the recent court decision, so there may still be deadlines that apply. The Court has created a problem for potential claimant by not imposing a deadline for joining the current group claim(s). If you want advice about any deadlines that may apply in relation to your investment, you should seek legal advice.

When I said compensation under any FCA scheme “is significantly smaller than the potential private redress claims”, I was referring to the proposal of compensation of £306m made in 2022 by the FCA. There is significant uncertainty in terms of what will or might come from the FCA and what will happen in the legal case. This wording was not and also should not be taken as legal advice.

At the end I say that investors should keep an eye on developments and their options via the relevant forums / newsletters / Facebook groups. I think it is pretty obvious, but I wish to caution you again against making any conclusion from those forums and Facebook groups – they cannot be relied on for legal advice about options and deadlines, and so I am pleased to re-emphasise, re this section and the update generally, to make clear that for any advice about their options and any deadlines, investors should seek legal advice.

Thanks for the update Mr Weight…. This process appears to become more complex and convoluted as time progresses…. just hope I still have all my faculties when the day of decision is finally reached!