The UK Stewardship Code 2020 is (according to the FRC) “a substantial and ambitious revision” to the 2012 edition of the Code which takes effect from 1 January 2020.

The FRC says “The new Code sets high expectations of those investing money on behalf of UK savers and pensioners. In particular, the new Code establishes a clear benchmark for stewardship as the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.

There is a strong focus on the activities and outcomes of stewardship, not just policy statements. There are new expectations about how investment and stewardship is integrated, including environmental, social and governance (ESG) issues. The Code asks investors to explain how they have exercised stewardship across asset classes. For example, for listed equity, fixed income, private equity, infrastructure investments, and in investments outside the UK.”

I am pleased that there will be a focus on outcomes as well as activities and that the expectations set are “high”, but I am not sure how this will be demonstrated.

The draft definition of Stewardship in DP19/1 was:

‘Stewardship is the responsible allocation and management of capital across the institutional investment community to create sustainable value for beneficiaries, the economy and society’.

The words across the institutional investment community have been deleted and those parts in bold underlined added, see below.

The Final definition in the 2020 Stewardship code is:

Stewardship is the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.

We were heavily critical of the FCA /FRC in our response to DP19/1, e.g. “Your definition [of Stewardship] is too narrow as it excludes individual investors. Individual investors own 29% of AIM and 12% of the main market by value. They have an important role in stewardship and to ignore them is wrong.” The new definition appears to be inclusive of individual investors, so the FRC/FCA appear to have listened to our concern.

The final definition is a much better definition. Oversight is a better word. Stewardship is not micro-management and oversight better conveys what we as investors and savers want from our stewards.

Sustainable Value for beneficiaries has been changed to long-term value for clients and beneficiaries…., which better reflects that asset managers have clients (e.g. asset owners who have beneficiaries e.g. pensioners).

Value for beneficiaries, the economy and society is replaced with value for clients and beneficiaries leading to sustainable benefits forthe economy, the environment and society. This is another good change as it emphasises the primacy of shareholders, whilst recognising other stakeholders. The previous definition was incompatible with S172 of the CA 2006. The new definition is OK.

In our ShareSoc-UKSA response to DP19/1, we questioned the cost benefit of stewardship:

“We note that the 2016 FCA Asset Management Market Study Interim Report MS15/2.2, noted inter alia:

- The annual average disclosed fee for actively managed equity funds available to UK investors is 0.90% of the assets under management (AUM) and the average passive fee is 0.15%. Furthermore, transaction costs (charged when asset managers trade on investors’ behalf) are normally higher for active funds (as illustrated in Figure 1.2). (p10 para 1.3)

- Asset management firms have consistently earned substantial profits across our six-year sample, with an average profit margin of 36%. These margins are even higher if the profit- sharing element of staff remuneration is included. (page 14, para 1.21)

These were damning criticisms of the industry. There are very relevant to the Stewardship Code as stewardship requires resources and, we argue, excessive profiteering is one of the reasons that asset managers and asset owners under-resource stewardship activities and provide a high cost, poor service as a result.

The criticisms are also relevant to this discussion paper as unnecessarily high fund managers’ fees are extremely concerning to asset owners and to the ultimate beneficial owners. Costs and performance can be of far more significance than how the fund manager addresses stewardship. We think these issues need to be addressed at the same time, separately but in parallel. We worry that an over focus on stewardship may be a diversion from the bigger problem of fees and performance.”

It is not clear if the FRC have recognised our concern.

In summary, much of the Code looks OK, but it is difficult to see exactly how it will work in practice. It could lead to a lot of boilerplate, or asset owners and asset managers may embrace it. We shall see.

FCA Response to DP19/1

At the same time, the FCA published its response to the DP19/1 joint FCA/FRC Consultation: Building a regulatory framework for effective stewardship Feedback to DP19/1 -Feedback Statement FS19/7 . In summary, the FCA are not proposing to do anything dramatic, but are going to wait and see if other initiatives improve the situation.

The FCA say “We agree with the view of most respondents to DP 19/1 that we should not impose further stewardship-related requirements on life insurers and asset managers now. We also agree that we should let firms first adapt to our new rules on shareholder engagement (implementing the revised Shareholder Rights Directive (SRD II)), which took effect in June 2019, and other related measures.

We have, however, identified several things we should do, working with industry, the FRC, Government and other regulators, to help address some remaining barriers to effective stewardship. Our actions build on existing initiatives, some of which were announced in our Feedback Statement on climate change and green finance (FS19/6). They include:

- Examining how asset owners set and communicate their stewardship objectives and taking actions to promote arrangements between asset owners, asset managers and service providers that support these objectives.

- Helping to address regulatory, informational and structural barriers to effective stewardship practices, including by consulting on rule changes to enhance issuers’ climate change disclosures.

- Considering further the role of firms’ culture, governance and leadership in both the management of climate risks and the exercise of stewardship.

- Pursuing a number of actions to promote better disclosure of firms’ stewardship practices and outcomes.

We will consider the need for any further actions as the UK Stewardship Code 2020 takes effect, so that the regulatory framework continues to support effective stewardship.”

The FCA’s main action point is “An industry workshop on setting a clear purpose for stewardship.” This all seems a pretty lame response bearing in mind the recent problems with Carillion, Conviviality and Thomas Cook, etc.

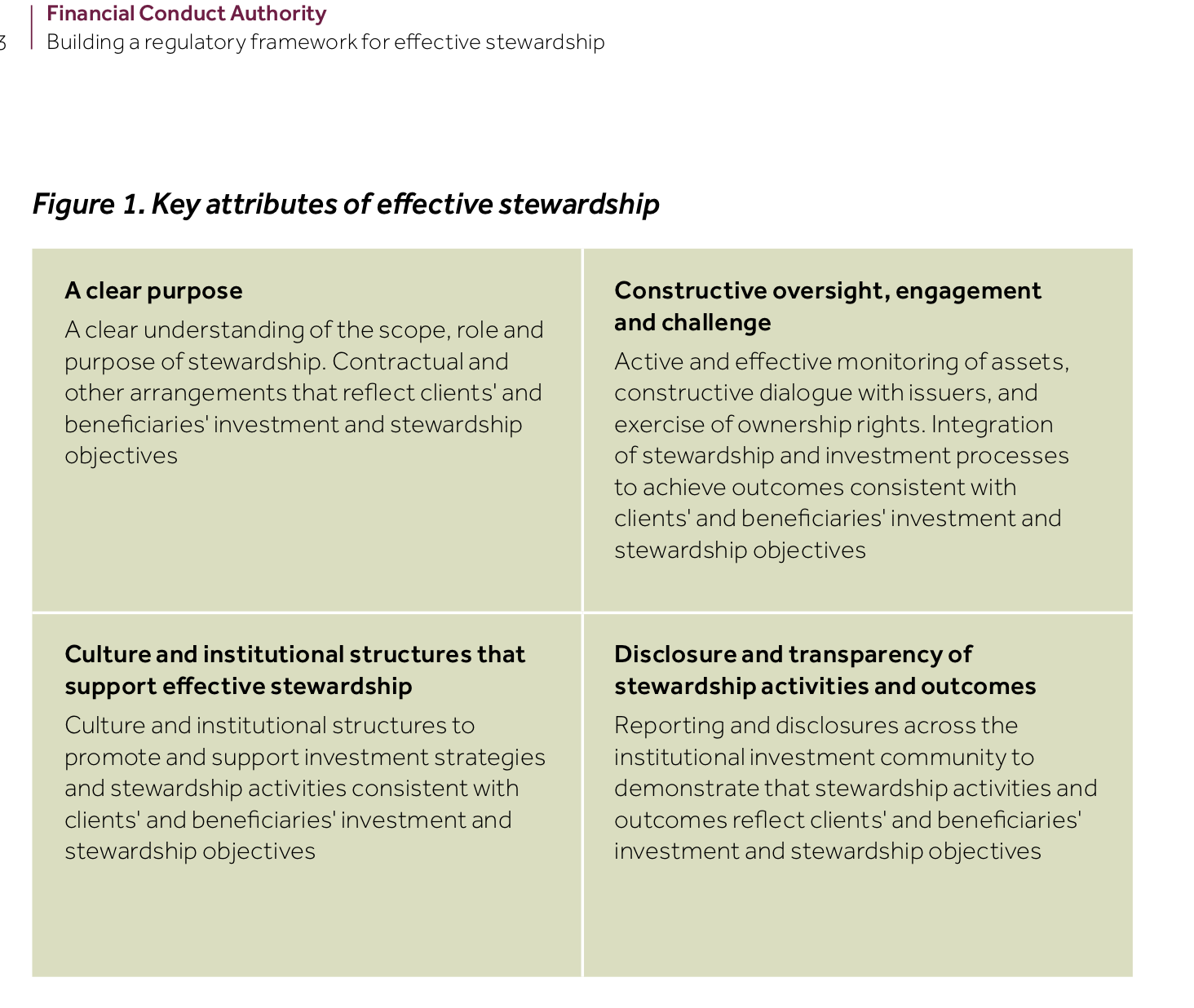

However, we have spotted some useful points they make in the depths of their report. For example, this neat matrix of key attributes of effective stewardship:

Re Voting in Nominee Structures the FCA report says

DP19/1 noted that questions have been raised about how retail shareholders exercise their rights where they have a direct investment and hold shares on the share register via a nominee company.

A small number of respondents had concerns that, in these circumstances, nominee companies may not adequately support voting in line with beneficiaries’ preferences. In this case, beneficial owners cannot vote unless nominees vote on their behalf or a special arrangement is made for them to do so.

One stakeholder said there should be ‘a greater public awareness of difficulties related to voting where there is a pooled nominee somewhere in the chain’. Another stakeholder representing shareholders commented that providing for shareholders who hold their shares in nominee accounts to vote their shares easily and at no additional cost is critical to shareholder rights and shareholder democracy.

I am pleased to report that the FCA response was helpful to our shareholder rights campaign:

We also note the problems stakeholders have raised about exercising retail shareholder rights where shares are held by a nominee company. We will support the Law Commission’s scoping study on intermediated securities, providing input on the implications of holding securities via nominees for the exercise of shareholder rights.

And on page 34:

4.33. Respondents also identified the role of nominee companies as a barrier to stewardship by retail investors (Barrier 7). For example, there have been questions about how retail shareholders can exercise their rights where they have a direct investment and hold shares on the share register via a nominee company.

4.34. BEIS has asked the Law Commission to produce a scoping study. This will provide

an accessible account of the law and identify issues in the current system of intermediation of securities. As part of this process the Law Commission has published a call for evidence. This runs until 5 November 2019. We will support the Law Commission’s scoping study, providing input on the implications of holding securities via nominees for the exercise of shareholder rights.

Our response to the FCA/FRC Consultation is here:

Cliff Weight, Director, ShareSoc

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.