This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

5 years on and the FRC has fined KPMG for its performance over Quindell. It has taken far too long. The settlement received a huge amount of coverage in the press, e.g. https://www.ft.com/content/e8ce1a30-6d3d-11e8-852d-d8b934ff5ffa

The FRC’s official announcement can be found here: https://www.frc.org.uk/news/june-2018/sanctions-in-relation-to-the-audit-of-quindell-plc

The KPMG fine of £3.15 million is derisory. It is absurd when compared with the (£2bn) shareholder losses as a result of being misled by the accounts. The average KPMG partner was paid £519k in 2018, and many were paid more. To suggest that a fine of £84,000 for one audit partner will affect partner behaviour is ridiculous.

In the context of KPMG’s worldwide turnover of $29bn, these fines look tiny, and arguably a small cost of doing business and not a deterrent.

This also highlights the weakness of the FRC report last year https://www.frc.org.uk/getattachment/e7c1b326-55b9-4676-8b60-b191037b2486/Sanctions-Review-Report-(November-2017).pdf , which purported to be a sign of change. I find it very difficult to read and understand the intent. The outcome is however quite clear. Modest fines, 5 years after the event and minimal change, at slug like pace.

It is a shame the FRC did not listen to us more last year when they sought views. Our response is here https://www.sharesoc.org/wp-content/uploads/2017/07/FRC-Consultation-Independent-review-of-sanctions-guidance-UKSA-SS-response.pdf

and in relation to question 4 of their consultation we said:

Firms should also be exposed to sanctions. Fines are almost certainly not the answer by themselves. A better approach would be to have a public register of firms (and individuals) that have had sanctions taken against them (e.g. reprimand or severe reprimand). It should also be obligatory for any firm bidding for work to have to state whether it has ever had any sanction taken against it (regardless of whether the client ITT itself asks for this). In the most serious cases we would like to see more instances in which audit firms are prohibited from taking on new listed company audit clients for a specified period of time. Even if that period of time is relatively small, such as one month or three months, as a sanction we believe that it will be taken much more seriously by audit firms and the listed companies which engage them than a sanction such as a “severe reprimand”.

Firms should also have to make good client losses resulting from negligence or misconduct. The extend of any ‘making good’ would need to vary depending on the extent of any contributory negligence or complicity on the part of the client.

We shall (jointly with UKSA) be making a submission to the Kingman review of audit firms. My initial thinking is:

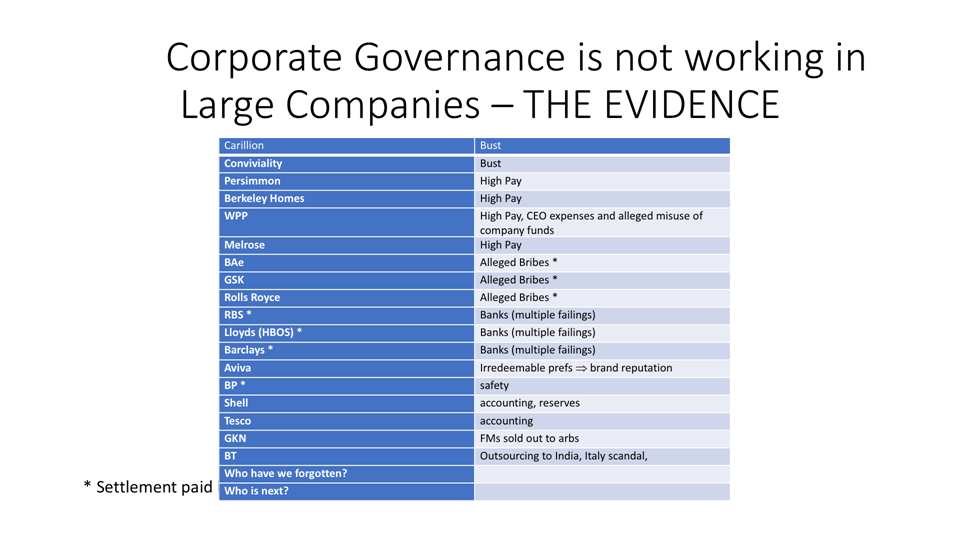

The FRC are in a state of denial about how big the problem is. Below is a list of problem cases. It is not one or two. It is huge.

I would summarise the FRC role as:

- Accounting issues, standards and ways of working, setting and guiding the profession

- Discipline, and dealing with problem cases

- Corporate Governance Code for UK listed companies

- (Investor) Stewardship Code for fund managers investing in UK listed companies

- In respect of actuarial profession similar to items 1 and 2 above.

The normal process with a company that is failing is that those in charge insist that management slim down the operations to only the really essential things. Anything that is non-core is sold off or exited. In some cases a takeover is required to install new management. Similar logic should be applied to the FRC.

So what should be done? The Corporate Governance Code should never have been given to the FRC. They are accountants and not corporate governance experts. They prefer bean counting to making judgements and fail to understand how value is created and how it should be measured and managed. The Corporate Governance Code needs to be run by an independent body.

Stewardship Code is to me a misnomer. Stewardship is an ethic that embodies the responsible planning and management of resources. Stewardship is now generally recognised as the acceptance or assignment of responsibility to shepherd and safeguard the valuables of others. The shareholders own the company. Their primary stewards are the managers of the company and the NEDs. Fund managers also have a role as stewards. The Stewardship Code would be better named as the Investor Stewardship Code as it only covers a subset of the stewarding activity.

The FRC, which is dominated by accountants and ex accountants has proved itself incapable of enforcement and prosecuting misconduct with the necessary vigour. We now have huge overlaps with SFO, DPP, BEIS, FCA, etc. Many of the accounting issues impact consumers and investors, so I would ask BEIS (who at present can strike off directors) or the FCA to take on the job of enforcement of accounting issues. They need to be given more resources to do this more quickly. And the ability to plea bargain to get cases settled much more quickly.

Which leaves us with a much smaller core task, item 1 above.

My point about denial is that there are four stages required for change: denial, acceptance, planning and implementation. The FRC has a huge problem of changing its culture to accept that for the last 20 or 30 years the audit and accounting profession has so seriously failed its customers and UK society generally. They deserve to be broken up.

Cliff Weight

Director, ShareSoc

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.