This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

As share prices of almost every share on the market collapses, should all trading be suspended? The argument for this is that as the impact of the coronavirus on the economy is not certain, although it looks more dire every day, shares cannot be valued with any certainty. Indeed there seems to be no hiding place as there never is in a bear market – almost all share prices have fallen. The editor of the FT thinks the market should not be closed and I agree with her. Closing the market is very prejudicial to private shareholders, particularly those who absolutely need to move into cash even if it means some sell into an unrealistic market – but that is their choice. If the market closes you have no choice. If there was to be a closure, it should only be for a few days as at the start of World War II.

I have been trend following in the market as I have mentioned before but it has proved difficult to keep up in the last few days. At least brokers’ systems seem to be robust this time around.

The major sectors affected by the virus, or soon will be, are hospitality businesses, hotels, pubs, entertainment venues and airlines. One symptom is that I just cancelled our holiday in June as I am supposed to be hibernating for 12 weeks according to the Prime Minister and I doubt the epidemic will have passed by June. But you can see that there will be many staff lay-offs in such businesses and airlines are already asking to be bailed out by the Government because if airplanes don’t fly they cannot cover their aircraft lease costs.

Meanwhile the virus is causing businesses to get their staff to work from home, including one of my brokers. Payment company Equals Group (EQLS) issued a statement this morning giving their response to the virus and a trading update. They say they have 50% of their staff working remotely in shifts and can move to 100% when required. As regards trading, group revenues to the end of February were up 33% but there has been a marked slowdown in travel cash and retail card revenues in the last week due to the adverse impact on travel. But corporate revenues are still robust so far and account for the majority of revenues. Clearly the business will be impacted to some extent so they are cutting costs to conserve cash. The share price had anticipated this and had already fallen a long way in previous days and weeks – it fell again today.

Another company in the payments sector is Finablr (FIN) which announced yesterday that the shares were suspended. The company suggests that problems with liquidity are making it difficult to manage the business. They have also discovered some cheques dating back to before their IPO which have been used as security for the benefit of third parties – a small matter of $100 million is involved! The CEO has resigned and the board is looking for a new one. This company was founded by B.R.Shetty who also founded NMC Health and whose accounting and financing arrangements are also under scrutiny. It looks like Finablr is yet another financial disaster I have managed to avoid to look on the bright side. I would not bet on shareholders recovering anything. Temporary suspensions very frequently turn into permanent ones.

Another company that operates in the mobile commerce and payment sector is Bango (BGO) who issued their final results today. Group revenue was up 41% and they say “Adjusted EBITDA” for the year was a positive £0.45 million. However cash declined because of the large expenditure on intangible assets and there was still an overall financial loss. They expect the “payments business to continue to grow exponentially” and they forecast the coronavirus to have a positive impact on End User Spend as from experience they see consumer spending rise during “stay-at-home” periods such as Ramadan and Christmas. The share price rose slightly today by the time of writing this note, but investors are still unsure about the future of the company it seems. Investors are either taking their money off the table altogether or moving out of businesses likely to be impacted by self-isolation and quarantining and this is having a very wide impact.

My portfolio is now over 25% in cash which is very unusual but I am picking up the odd few shares in companies where the panic seems overdone – in none of the sectors likely to be affected that are mentioned above though.

One of the few companies I hold whose share price rose in the last 2 days has been Ocado (OCDO) as the popularity of on-line ordering and delivery rises. Getting delivery slots with them is now difficult for customers and other supermarkets are having similar problems and when you do get a delivery a lot of items are missing. There is clearly some panic buying going on for certain items which may subside if logistics turns out not to be a major problem after all. But surely all the workers who pack and delivery from supermarkets are going to be affected if the virus becomes rampant, even if they are in the younger and healthier group.

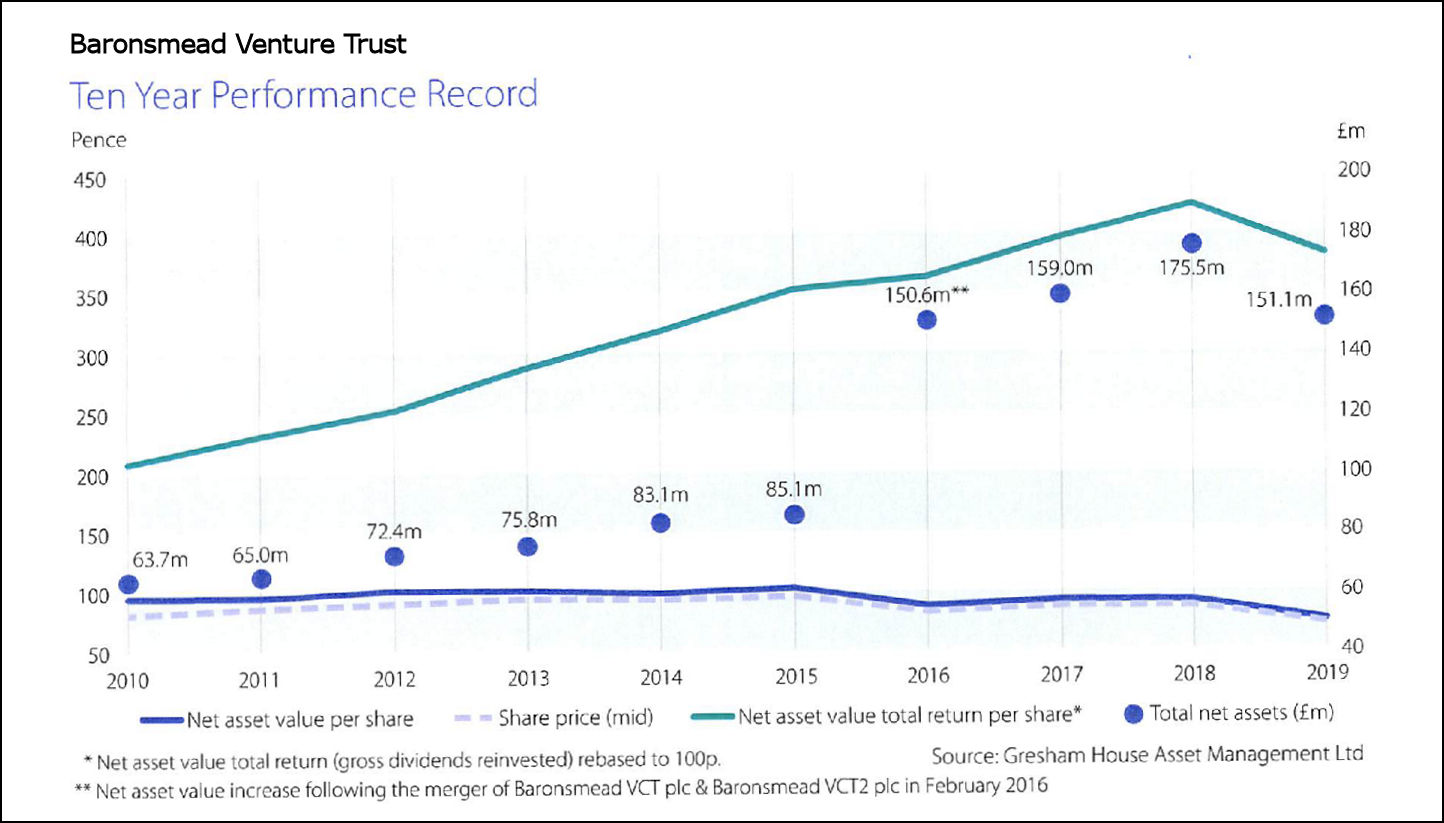

I mentioned some issues at the Baronsmead Venture Trust (BVT) AGM in my AGM report here: https://www.sharesoc.org/agm-reports/baronsmead-venture-trust-bvt-agm-2020/. I wrote to the Chairman of the company, Peter Lawrence, after the meeting and have received a response. He confirms that the chart of returns in the last ten years in the Annual Report on page 3 was wrong. It showed a decline in NAV Total Return in 2018 when there was in fact an increase – a corrected graphic is below.

It always surprises me that there are so many errors in Annual Reports that shareholders find easy to spot when the directors have not. This seems to be a particular problem in VCTs – perhaps too many jobs and not enough time allocated to each role with some VCT board directors considering their directorship a sinecure that requires little thought or effort. I suspect those are the problems. Perhaps they need reminding to read the Annual Report in detail before approving it!

Mr Lawrence rejected my complaint about the lack of time allocated to public questions at the AGM Meeting (only 15 minutes) and also rejected my complaint about the length of time he has been on the board which is contrary to the UK Corporate Governance Code. I will send him a stiff reply. To my mind this looks like one of those VCTs where a revolution is long overdue. It needs a fresh board and a good examination of the investment policy, the fund manager and the fees paid to the manager.

The author holds shares in Equals, Bango, Ocado and Baronsmead Venture Trust and not in other companies mentioned in this article.

Roger Lawson (Twitter: https://twitter.com/RogerWLawson )

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.