DISCLOSURE – I hold shares in CLIG and you should consider my comments in that light and with appropriate scepticism – DYOR!

On 23rd October I attended CLIG’s AGM and Investor Afternoon. These were well advertised, at convenient times and locations and open to all investors – as ShareSoc encourages all businesses to do.

Roger Lawson and UKSA’s Gerald Roberts joined me at the AGM, and Gerald for the Investor afternoon. A key issue which I raised at the AGM was succession planning, with CEO, Barry Oliff due to retire in two years’ time. This was largely addressed at the afternoon event, where the management team was given the opportunity to demonstrate their own attributes and that the firm would be in good hands following Barry’s departure.

I take further confidence in the firm’s future from the culture Barry has embedded in CLIG, being one of collegiate values, rather than of identifying “stars” and rewarding individual performance. This has led to an unusual remuneration scheme, where rewards are linked simply to the profitability of the firm. Unfortunately the “tick box mentality” of some institutional investors has led to some opposition to this scheme, mentioned in Roger’s blog post on the AGM here: https://www.sharesoc.org/blog/regulations-and-law/lloyds-litigation-collective-redress-clig-agm/

As in the title of this post, CLIG’s transparency is exemplary. Staff share in the firm’s success by means of a bonus pool comprising 30% of pre-tax, pre-bonus operating profit. Another illustration is that Barry has declared publicly in the annual report his intention to reduce his shareholding as he approaches retirement, in tranches of 250,000 shares at prices of 425p and 25p increments thereafter (he currently holds 2.275m shares – 10% of issued capital). The firm also publishes regularly updated data which makes it easy for shareholders to estimate likely future profitability (and hence dividend cover), here: http://www.citlon.com/shareholders/announcements.php

This profit transparency is aided by a simple business model, with revenues being driven by a standard percentage fee of funds under management (FUM) and costs being largely fixed (apart from the bonus pool mentioned above). Being an asset manager means that this is a “capital light” business, which in turn leads to excellent return on capital. Having said that it is also notable that the balance sheet is very strong, with substantial net cash and minimal long-term liabilities.

This results in CLIG being classified by Stockopedia as a “Super Stock” with a StockRank™ of 96.

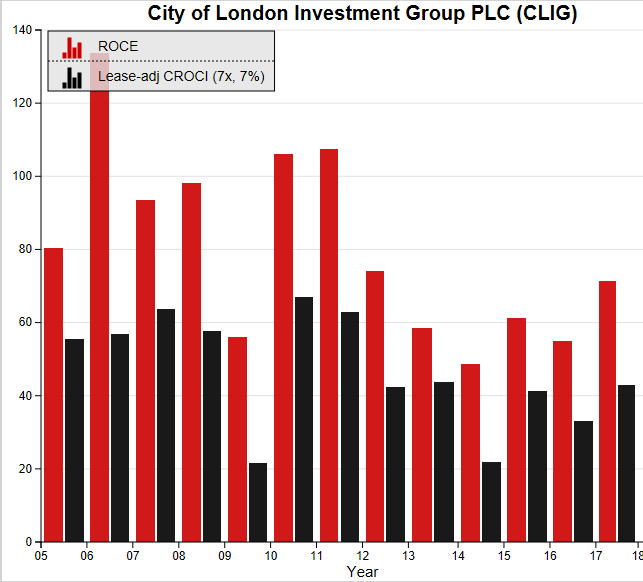

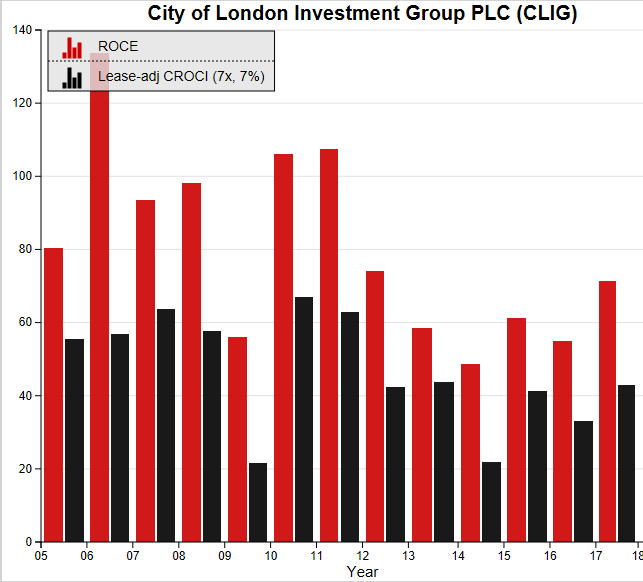

SharePad analyses the ROCE and CROCI (cash return on cash invested) as follows:

As you can see these are both exceptionally high.

Finally, most of that generated cash is returned to shareholders as dividends, with a current policy to pay out some 80% of post-tax profits as a dividend, resulting in a yield > 6% at the current share price.

The chief risk to future profitability is a collapse in emerging markets, leading to a big fall in FUM.

Mark Bentley