This article reflects the opinions of its author and not necessarily those of ShareSoc.

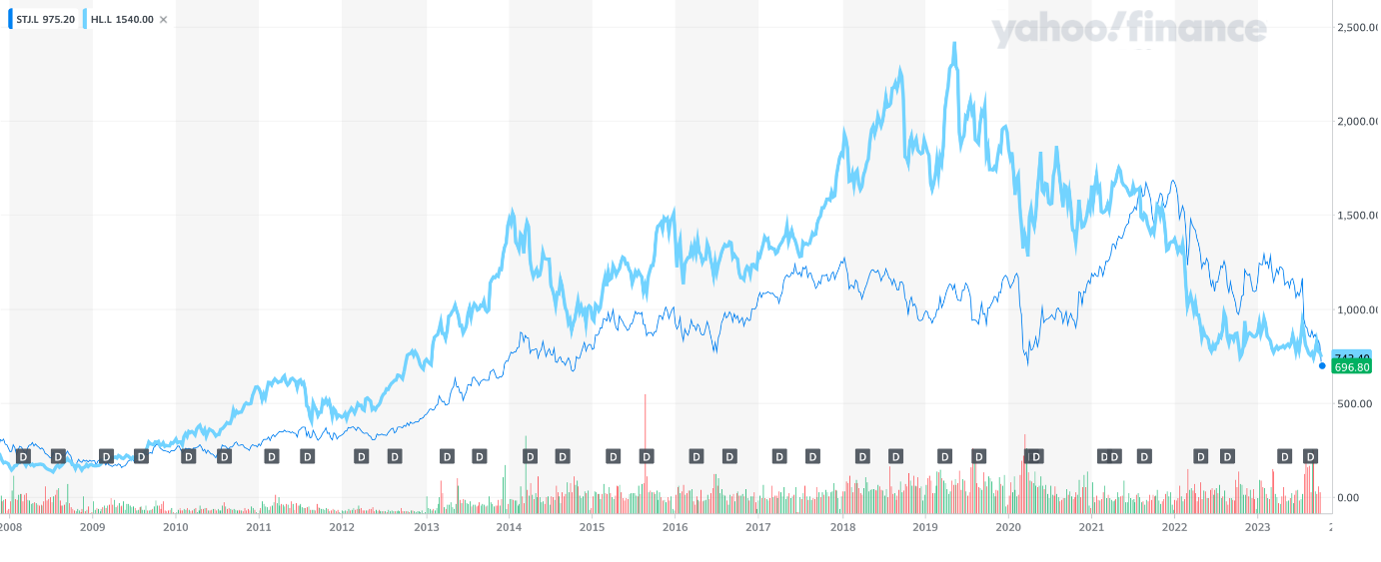

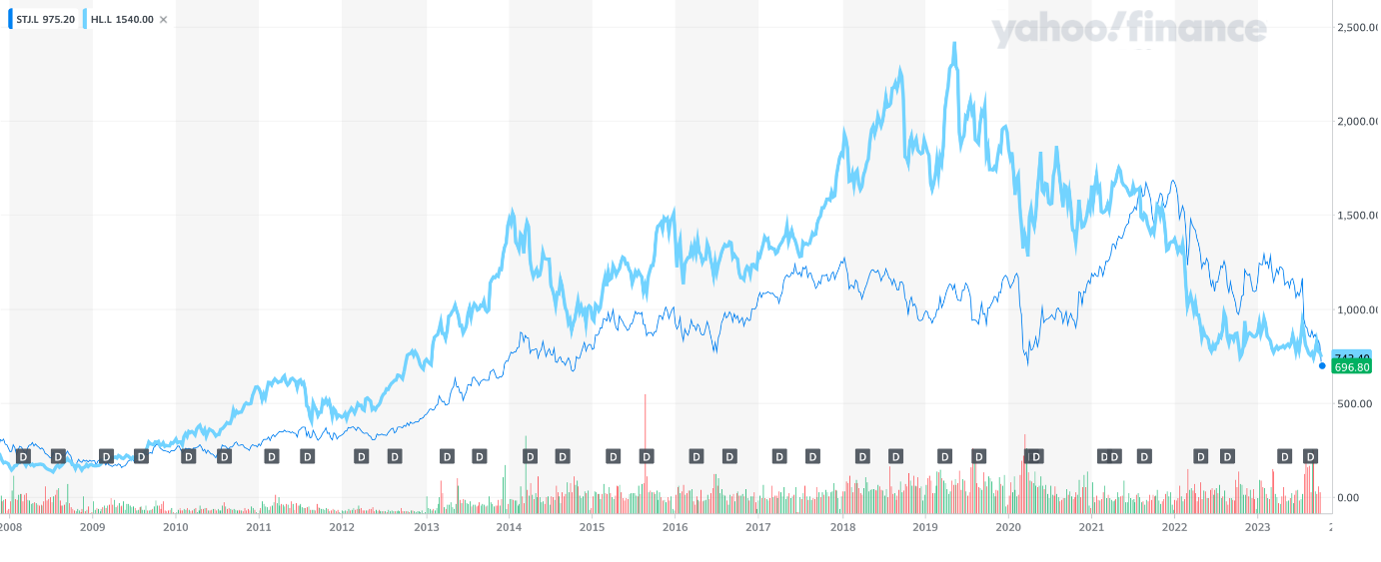

Shares in the FTSE 100 group SJP (St. James’s Place LSE: STJ) have shed more than 35 per cent since July, when SJP announced modest changes to fees in response to the rules. The shares were down 8 per cent in early trading on Friday.

Investors’ concerns over its business model have intensified since the Financial Conduct Authority introduced its Consumer Duty in July, which forces financial services companies to show they are acting in customers’ best interests.

However, Hargreaves’ shareholders have done far worse than SJP’s – so far.

An excellent article in the FT highlighted these issues at SJP, but the decrease in share price at Hargreaves has been worse. Hargreaves problems not only extend to fees, but also to its Wealth Lists and its promotion of Woodford Funds. The FCA has been looking at Hargreaves’ role in the Woodford scandal and has still not published its report.

However, I quite like what the FCA is doing in respect of the consumer duty.

Cliff Weight

ShareSoc member

Disclaimer: The author does hold a small number of Hargreaves shares. The author does not hold shares in SJP.

I’m a HL shareholder so I’m probably biased, but regarding the impact of the new consumer duty regulations on HL, we shall see.

More generally, I think there is a material risk that ever-tighter regulation, especially regarding product pricing, may have negative unintended consequences, as has very obviously been the case in the now-broken energy market, which was largely caused by the government’s and regulator’s desire to see more competition and lower prices.

The reality is that manipulating markets to increase competition or lower prices isn’t always a good idea if the end result is a worse outcome for consumers, because firms are forced to take shortcuts in order to offer unrealistically low prices.

HL’s position is somewhat like Centrica (British Gas): Some people are happy to pay more in order to get what they believe is best-in-class service and a feeling that they’re with a “safe” provider. Not everyone wants to skip hither and tither just to get the lowest price in the market, because then you run the risk that you’re with the lowest-quality supplier in the market.

But, as with the energy market, it may be a decade before we know if consumer duty was a good idea or not.

Hi John. I think your line of argument is too pessimistic here. The case of the financial sector doesn’t compare with utilities where the govt has intervened in far more detail to affect pricing structures and levels. Having said that, most of the failures in utilities are not caused by the regulation but by the failure of companies to hedge their wholesale vs retail commitments and/or debt levels effectively. The consumer duty regs primarily force providers to be much more transparent about their pricing structures and levels and to justify any differences in pricing between customers. The regulations don’t enforce any price caps or specific structures on the industry. As a result, I think we are going to see prices more accurately reflect the real costs to serve which is no bad thing. Hitherto, the opaque pricing and terms of some providers have been a source of unusually high margins and these will now revert to more normal levels – hence the inevitable fall in share prices.

Hi Michael, thanks for the clarification. I agree that the regulator isn’t looking for specific price controls, but it does set the “mood music” and in the energy market, the music said that low prices were the number one priority, which was a key reason why many of the newer firms were willing to cut costs by not sufficiently hedging their risks.

I’m all in favour of pricing transparency, so I am in favour of consumer duty, but only if the associated costs and unintended consequences don’t outweigh the benefits. Let’s hope they don’t.

The FCA is not setting prices true….but for compliance firms must benchmark themselves against what they know of the competition. While the idea is NOT that firms will collude to fix prices….if a firm finds that its charges for product A is lower than market average and its charges for product B is higher than average…..one can see what will happen over time !

This Dec 2023 story highlights a future debt financing issue for off balance sheet loans……..St James’s Place mulls asking outside investors for £1bn

https://www.thetimes.co.uk/article/44a0edff-1964-4abf-92fb-bf9f1c7b548b?shareToken=f216e623f29cb4896cfd34df8300b5e0

St James falls 19% after results. The worries about SJP were highlighted here in the above article in Oct2023

Latest news is here St James’s Place shares tumble after provision for complaints

https://www.thetimes.co.uk/article/60addead-afce-4927-ba10-d7d84843a57e?shareToken=b4413ab916d9da3a7a30c745d5dea0c2

985p offer on April 26th has been rejected by Hargreaves Board. https://app.stockopedia.com/share-prices/hargreaves-lansdown-LON:HL./news/cvc-advisers-adia-considering-possible-offer-for-hargreaves-lansdown-updated-urn:newsml:reuters.com:20240522:nL4N3HP3TJ?source=Search

Hargreaves share price now £10.80.Its recent low was <£7! This is another example of UK fund managers being unable to value shares correctly.

Bidders are advised by Goldman Sachs, who have a history of success in these encounters!