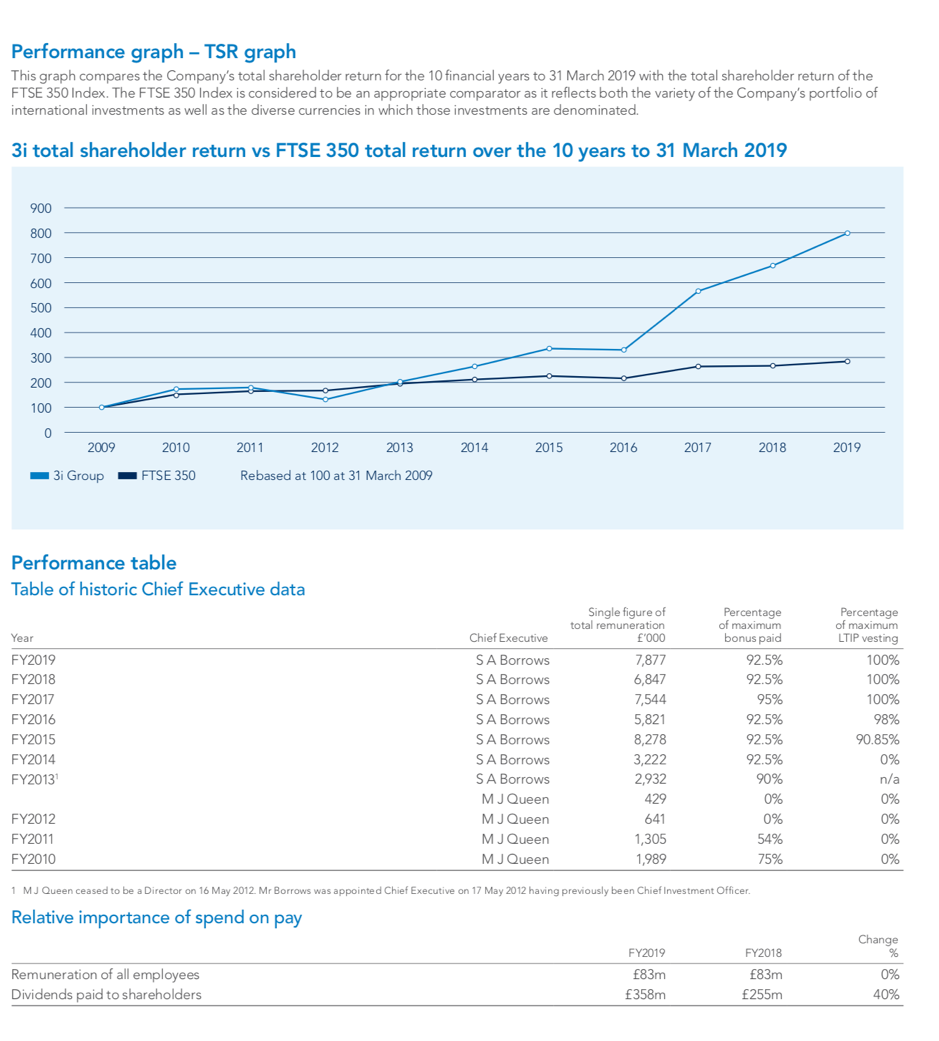

The 8 times increase in the 3i share price in the past 10 years means that 3i is one of the largest holdings in my portfolio. So I thought I ought to read the annual report of this £11 billion market cap company.

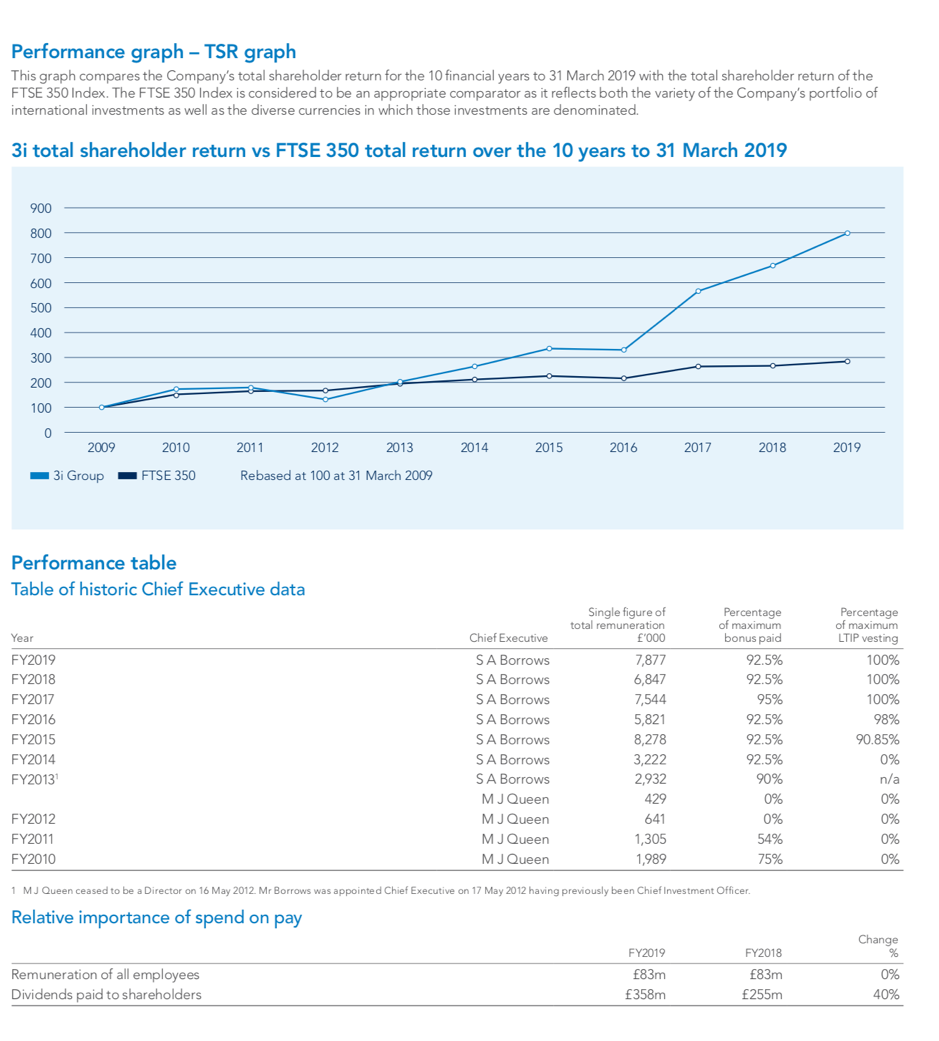

CEO Simon Borrows has accumulated £160 million of 3i shares and is therefore very well aligned with shareholders. His annual pay is around the £7 million mark, but most of this is performance based and paid in shares. He has a lowish salary (£600k), bonus of up to 400% salary and annual LTIP award of 400% of salary. The bonus is paid 20% in cash and the rest in shares deferred for up to 5 years. His pay may not fit the guidance we offer in the ShareSoc Remuneration Guidelines https://www.sharesoc.org/wp-content/uploads/2016/05/ShareSoc-Remuneration-Guidelines-Large-companies-2016.06.07-.pdf but I am not complaining. This is a special case, a very high performer in a highly complex and competitive industry.

Most importantly, the executive directors do not participate in the carry plans that other employees enjoy. This separation enables better governance.

Of even more interest is the carry plan, normally between 10% to 12% of gross returns in 3i investments. 3i has 241 staff who were paid £83 million between them, PLUS CARRY.

Overall, the effect of the income statement charge, the cash movement, as well as the currency translation meant that the balance sheet carried interest and performance fees payable increased to £970 million(31 March 2018: £870 million).

Much of this will be deferred and paid out over many years. This is great for retaining key staff. Key staff are key to future performance.

I was recently criticised for saying that the norm for private equity and venture capital funds is no longer a 20% performance share. The fact that market leader 3i limits the carry to 10 to 12% is further proof I am right and my critics were wrong.

I also have a small holding in Vietnam Holdings (VNH). Their performance fee is 12% above a hurdle of 8%.

Also noteworthy is the VNH management fee of 1.5% on NAV up to $300m, reducing to 1.25% on NAV between $300m to $600m and just 1% on NAV above $600m. Some VCT fund managers who operate multiple VCTs should take note and think of consolidating different classes of shares, merging funds and reducing the management fee they charge their customers.

If you have not yet joined the VCT investor group, please do so now. goto https://www.sharesoc.org/campaigns/vct-investors-group/

Cliff Weight, Director, ShareSoc