BARONSMEAD VENTURE TRUST PLC (BVT)

BARONSMEAD VENTURE TRUST PLC (BVT)

Blog posts

Baronsmead VCT – More Corporate Governance Issues

The opinions expressed in this article are those of its author and not necessarily those of ShareSoc.

I mentioned in a previous blog post that covered Northern Venture Trust that “VCTs are a perpetual problem in relation to excessive management fees, poor corporate governance, and general behaviour prejudicial to the interests of shareholders”.

Now we have an AGM for Baronsmead VCT (BVT) in prospect on the 16th February. As a holder I will be expressing the following concerns to the Chairman:

In the ...

Equals Trading, Bango Results, Finablr Suspension, Baronsmead VCT and Closing the Stock Market

As share prices of almost every share on the market collapses, should all trading be suspended? The argument for this is that as the impact of the coronavirus on the economy is not certain, although it looks more dire every day, shares cannot be valued with any certainty. Indeed there seems to be no hiding place as there never is in a bear market – almost all share prices have fallen. The editor of the FT thinks the market should not ...

Post Date: March 17, 2020

Read more

VCT Investors Group Action Plan

23 ShareSoc members who are also members of the VCT investor group met on 26 February 2020 at the East India Club. We reviewed recent successes at Ventus, Albion,...

Post Date: March 16, 2020

Read more

VCT News – Baronsmead, Northern VCTs and Foresight 4

I attended the Annual General Meeting of Baronsmead Venture Trust this week (on 14/2/2017). It was not particularly well attended perhaps because of the early start time of 10.00...

Post Date: February 16, 2017

Read more

Governance in Investment Trusts – Alliance Trust, Baronsmead VCT 3 and the Core VCTs

The battle for the soul of Alliance Trust continues - or so their Chairman would have it. But even institutional proxy advisors ISS and PIRC have now come out in support of Elliott Advisors and their resolutions to appoint three new directors at the AGM on the 29th April. Alliance have said they are looking for a new truly independent non-executive director, but will they be anyone who is likely to disagree with the existing board or take a contrary view? ...

Post Date: April 17, 2015

Read more

Ignoring the UK Corporate Governance Code

Last week there were Annual General Meetings of the Baronsmead 1 and 2 VCTs (BDV and BVT) and the British Empire Securities and General Trust (BTEM) on the same day. These companies are all investment trusts although the latter is of course somewhat different in nature to the two Venture Capital Trusts. They do have one thing in common though - they both claim to be able to report against the AIC Corporate Governance Code rather than the UK Corporate Governance ...

Post Date: December 22, 2014

Read more

AGM Reports

Baronsmead VCT AGMs 2023 and VCT Prospects

Today (1/2/2023) I attended the two Baronsmead VCT AGMs (BMD and BVT) via a Zoom webinar, partly because of the train strikes today but partly because I did not expect any momentous events or questions to take place, and so it turned out. But they did get a number of shareholders attending in person despite the train strikes.

However despite me registering for the event some weeks ago I did not receive a zoom invite and had to chase that up just ...

Baronsmead Venture Trust (BVT) AGM 2020

Yesterday (26/2/2020) I attended the Annual General Meeting of the Baronsmead Venture Trust (BVT) held at Saddlers Hall in the City of London. It was reasonably well attended. I will just report on the major issues:

The Net Asset Value Total Return for last year I calculate to be -2.7% which is certainly disappointing. Note that it is annoying that they do not provide this figure in the Annual Report which is a key measure of the performance of any VCT and ...

Baronsmead Venture Trust (BVT) AGM 2017

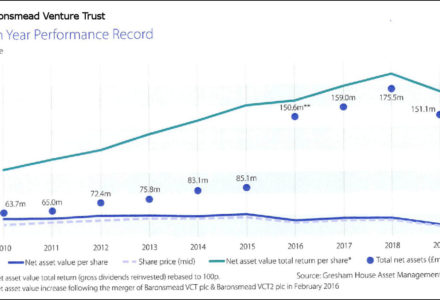

I attended the Annual General Meeting of Baronsmead Venture Trust this week (on 14/2/2017). This is of course a Venture Capital Trust (VCT) and one of the longer established ones with a good historic fund performance. It was formed from a merger between two Baronsmead VCTs (1 and 2) last year which of course incurred significant costs but those are being rapidly recouped.

It was not particularly well attended (I would guess about 40 shareholders) perhaps because of the early start time ...

Baronsmead VCT 1 and 2 Merger General Meetings (BDV and BVT) 2016

I attended the General Meeting of Baronsmead VCT this morning in London. It was immediately followed by a similar General Meeting for Baronsmead VCT 2, which I did not stick around for as my questions had been covered in the first meeting. These meetings were to approve the merger of these VCTs to form one larger Venture Capital Trust. The merger was on the usual "proportional net asset value" basis used for VCT mergers and as the two portfolios are almost ...

Baronsmead VCT plc (BVT) and Baronsmead VCT2 plc (BDV) AGM’s 2014

This report covers the Annual General Meeting of Baronsmead VCT 1 (BDV) and Baronsmead VCT 2 (BVT) which were combined together on the same day (today), along with a presentation by the fund manager between the two AGM’s. Both companies are managed by Living Bridge LLP, which as we know used to be called ISIS but had, for obvious reasons, to change its name. The meeting was held at Plaisterers hall in the city commencing at 10.30am.

We started with the Baronsmead ...

Baronsmead VCTs (BVT)(BMD) AGM Reports 2013

This report covers the Annual General Meetings of Baronsmead VCT 1 (the

original VCT of the family) and Baronsmead VCT 2 which were combined

together on the same day on the 18th December 2013. Both companies are

managed by ISIS of course. The meetings were at the Plaisterers' Hall on

London Wall in the City commencing at 10.30 am.

The AGM of Baronsmead VCT 2 was taken first, chaired by long-standing

Chairman Clive Parritt who was first appointed to the board in 1998 and has

been Chairman so ...

Baronsmead VCT 1(BVT) and VCT 2 (BMD) AGM Reports 2012

On the 11th January I attended the AGMs of Baronsmead VCT and Baronsmead VCT 2 which were held one after the other (with lunch intervening) at the London Stock Exchange building (one now has to enter via the back entrance to avoid the on-going “demonstration” outside St. Pauls).

It makes sense to combine these meetings to some extent because they have overlapping investments, overlapping shareholders and the same investment manager (ISIS).

These companies have been two of the more successful Venture Capital Trusts ...

- EDUCATION

- MEMBERSHIP

Copyright © 2025 All rights reserved. Sharesoc® (UK Individual Shareholders Society). Terms of use and legal information (note this site uses cookies)

Digital Marketing by Chillibyte.

Digital Marketing by Chillibyte.