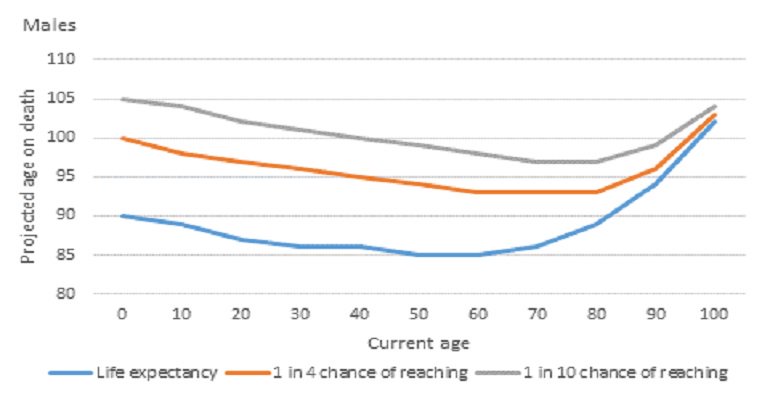

There was an interesting article recently published by Schroders on life expectancy. This can be quite critical to making investment decisions when you retire, if not before, or if you are living off your capital. It included the chart below which has been issued by the ONS.

How male life expectancy changes over time.

For example, a 60-year old man now has a 1 in 4 chance of living to 93 and a 1 in 10 chance of reaching 98. As you can see from the chart, once you get past 70, the chances of you living to a ripe old age substantially increases. This is probably because if you have reached 70 then you are either made of strong stuff or have been looking after yourself well. Or you have good doctors.

Of course within these figures there is a large variation in individuals so betting on the numbers can be tricky. But don’t ask your doctor for an estimate – from my experience they tend to be pessimistic to avoid disappointing the patient and their relatives. Being wealthy seems to help with life expectancy though, and you probably know all the unhealthy lifestyle choices that reduces it.

However it is a truism that you might live longer than you were expecting from this data and ensuring you have enough income to last out if you are self-investing means you almost certainly need to invest in the stock market as that is probably the only way to ensure your savings will not be eroded by inflation in the long term. That is particularly the case with current annuity rates which make no sense to use at present because of the very low rates imposed by Government manipulation of bond rates.

In summary it’s best to be conservative and minimise your erosion of capital. But those following the debates on Brexit in Parliament and on television of late may have lost the will to live, which is of course one of the most damaging factors in life expectancy. I hope the situation gets sorted out soon.

Roger Lawson (Twitter: https://twitter.com/RogerWLawson )