This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

Globo was one of those AIM companies that turned out to be a complete fraud. Back in December 2015 the Financial Reporting Council (FRC) announced an investigation into the audits of the company by Grant Thornton (GT). Even the cash reported on the balance sheet in the consolidated accounts of the parent company proved to be non-existent (or had been stolen perhaps). I have previously complained about the slow progress and the lack of any information on this investigation.

But former shareholders need no longer hold their breath – the FRC have announced that they have dropped the investigation on the basis that there is no realistic prospect of a finding of “misconduct” by Grant Thornton UK. It would seem that GT relied on the audits of the subsidiary companies in Greece and elsewhere over which the UK authorities have no jurisdiction.

There may be on-going investigations by other bodies including a review of the activities of GT in Greece but this makes it appear that the chance of action is fading away. Not that shareholders were ever likely to recover their losses. It is disappointing that the FRC have not taken a tougher line on this matter as questions about the accounts of Globo were publicly raised a long time before it went bust, and I even spoke to some staff of Grant Thornton UK at a Globo meeting telling them they needed to examine their accounts carefully. One would have thought that they would have done a very thorough examination of the subsidiary audits, but it seems not so.

I was about to submit my comments on the Kingman “Review of the Financial Reporting Council” – all ten pages of it – but will now have to amend it to include more criticism. I’ll publish it on the Roliscon web site a.s.a.p.

Another example of regulatory inaction is the announcement that the Financial Conduct Authority (FCA) will not be doing anything about the past activities of the Global Restructuring Group (GRG) at the Royal Bank of Scotland (RBS). After a review they found no evidence that RBS artificially distressed firms for their benefit (that’s not what the complainants say) although they did find inappropriate treatment of customers. But the FCA decided they could do nothing because some parts of the activities of GRG were unregulated and action against the senior management had little hope of success. So the perpetrators are off the hook.

I received an interesting newsletter from White & Case, one of the leading commercial law firms, which summarised the latest report from the FCA on their enforcement activities. It was headlined “FCA Enforcement – More cases, increased costs, fewer fines” which put the report in context. The number of “open cases” has doubled in two years while the number of staff has remained the same, i.e. more work but no more resources. Enforcement action has slowed down, probably for that reason, and fines have also dropped. Only 16 fines were imposed in the last year.

JPMorgan Japan Smaller Companies Trust

Yesterday I attended the AGM of JPMorgan Japan Smaller Companies Trust (JPS) which turned out to be a more interesting meeting than I anticipated. This is one of my Brexit hedges – pound falling means any overseas investment is likely to be a good one, and I always like small cap funds.

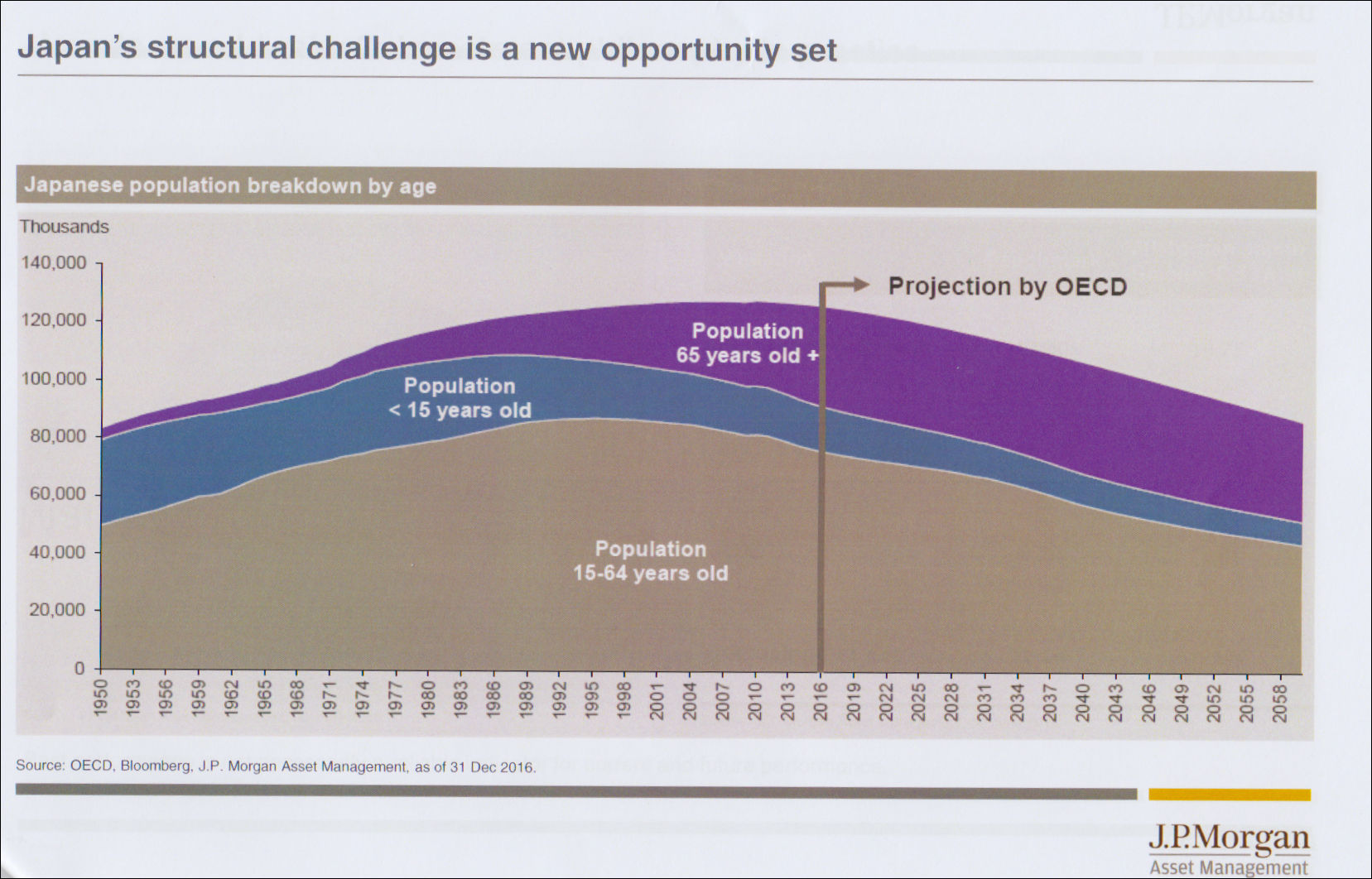

This trust has a good track record – NAV up 27.8%, 20.8% and 12.2% in the last three years so it is well ahead of its benchmark. Not knowing much about the Japanese market the presentation from the fund managers (via video from Japan) was particularly interesting. Equity markets in Japan have been buoyed by QE activities from the Bank of Japan – apparently they have not just been buying bonds but also equities in the stock market! But the economy is facing major structural challenges from an ageing and declining population. This was one slide they presented:

However, the managers are not too concerned because they ignore “macro” trends when investing anyway. They clearly think they can still achieve good results because of a focus on specific areas of the market, e.g. healthcare, employee benefits (staff are being paid more as they become in short supply), robot appliances, etc. Also corporate governance is improving, albeit slowly, which is of benefit to minority shareholders.

However, the managers are not too concerned because they ignore “macro” trends when investing anyway. They clearly think they can still achieve good results because of a focus on specific areas of the market, e.g. healthcare, employee benefits (staff are being paid more as they become in short supply), robot appliances, etc. Also corporate governance is improving, albeit slowly, which is of benefit to minority shareholders.

The other interesting issue that arose at this AGM was the proposed new dividend policy. They changed the Articles at the meeting to allow the company to pay dividends out of capital and also proposed a resolution to adopt a new dividend policy of 1% of assets per quarter, i.e. 4% dividend yield per annum when it was nil last year. This prompted a vigorous debate among shareholder attendees with complaints about it meaning shareholders will be paying more tax, often on unwanted dividends. The retiring Chairman, Alan Clifton, said the board had proposed this because they were advised that this would help to make the company’s shares more attractive to investors. The shares are currently on a persistent wide discount of about 11% and it was hoped this would close the discount. Also as most private shareholders now hold their shares in ISAs and SIPPs, there would be no tax impact on them. I pointed out direct shareholders could always sell a few shares if they wished to receive an “income” but there are obviously many small shareholders who do not understand this point or prefer to see a regular dividend payment. At least the above summarized the key points in the debate.

When it came to the show of hands vote on the resolution, it looked to me as though there were more votes AGAINST than FOR. The Chairman seemed to acknowledge this (I did not catch his exact words), but said that the proxy votes were overwhelmingly in favour. He then moved on to the other resolutions. I suggested he needed to call a poll, which of course nobody fancied because of the time required even though it would be legally the correct thing to do. So instead it was suggested that perhaps the count of hands was wrong so that vote was taken again – and narrowly passed this time. My rating as a trouble maker has no doubt risen further.

Anyway, I actually abstained on the vote on that resolution because I am in two minds on the benefit. As Alan Clifton pointed out, the impact of a similar change at International Biotechnology Trust (IBT) where he was also Chairman was very positive. My only comment to him was I thought 4% was a bit high. The board will no doubt review the impact in due course, but it seems likely that it will have a positive impact on the discount as the shares will immediately look more attractive to private investors.

In conclusion, what I expected to be a somewhat boring event turned out to be quite interesting. That is true of many AGMs. Japan might have more difficult “structural” challenges even than the UK, with or without Brexit. As regards the regulatory environment covered in the first part of this article I suggest the laws and regulations are too lax with too many loopholes. I think they need rewriting to be more focused on the customers or investors interests.

Roger Lawson (Twitter: https://twitter.com/RogerWLawson )

One comment

Digital Marketing by Chillibyte.

The proposal to pay dividends out of capital as well as income at JPS is part of a trend. I note that another J.P. Morgan Trust, JPGI (Global Growth and Income) did so a couple of years ago. The change had the effect of reducing the discount to NAV that JPGI generally traded at and it now tends to trade at a premium to NAV.

As an income investor, investments paying a good, sustainable, dividend are more attractive to me. The problem with the argument that you can generate an equivalent income by selling shares is that if you require a fixed, regular, income you will end up having to sell more shares when prices decline (and IT discounts widen), i.e. at the worst possible time. If OTOH an IT pays an income as a % of NAV, then the share price discount/premium becomes irrelevant to the income stream – only the NAV performance matters. Equally, the value obtained by an income-seeking investor from a company paying dividends as a proportion of earnings is unaffected by the vagaries of market sentiment.

When you seek to generate an income from your portfolio, pound-cost averaging works in reverse and it is preferable to generate your income from a dividend stream rather than being a forced seller at what may be unfavourable prices, dependent on market sentiment.

Mark Bentley