We remain absolutely focused on making sure retail investors have fair access to fund raisings. This is important, now more than ever, as many companies plan to return to the equity markets to shore up balance sheets and reposition for the future. I would not like to see the current circumstances become an excuse for extracting value from minority and small shareholders.

Marcus Stuttard, Head of UK Primary Markets, London Stock Exchange is very clear: “Retail or individual investor participation, is really important across our markets, both in AIM and the main market.”

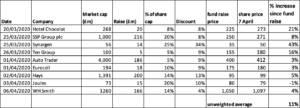

However, recent raises by Hays, WH Smith, SSP, Ten and Hotel Chocolate have all failed to include retail. Discounts have been in the 7% to 13% range, to prior share price, and in many cases the share price has rebounded and gone to a premium to the offer price. This is a significant transfer of value from those excluded from the offer to those included. Premium Bid estimate the average discount as 10% and the bounce to be 10%, so a 20% fund raise will see 4% of value transferred to those who participate.

Below is a link to Primary Bid’s recently published White Paper on why retail investors matter.

The Primary Bid approach means retail shareholders have the same opportunity as institutional investors to participate on the same terms, the same fees and at the same time. Retail take the same price as agreed with institutions that lead the fund raise. If there is no prospectus the retail allocation is limited to €8 million, which is often enough for retail to be given a 10% allocation, but even €8m for retail is better than nothing. If there is a prospectus, then no limit applies.

From our perspective, it has become clear that many businesses are going to have to fundraise as they shore up balance sheets and reposition for the next 12-24 months. When those inevitable fundraisings take place, we want to make sure that retail investors have fair and transparent access to those transactions. The updated guidance giving companies the ability to circumvent pre-emption rights only heightens the importance of making sure retail investors are systematically included.

When Companies raise funds through placings, they (sadly far too often) do not allow retail shareholders to participate. The argument goes that in order to make sure the fund raise is successful, the details need to be kept secret to the few key shareholders: if the details leak then this might prejudice the fund raise which might jeopardise the company. In today’s unprecedented circumstances one can see why some boards might accept this view as the gospel. However, it is not true, and we need to make sure all companies, Nomads, bankers and advisers know about the Primary Bid approach.

Below are a sample of recent fund raises. Most if not all suffered large decreases in their share price before the fund raise. However the ability to complete the fund raise has in 8 out of nine cases led to a subsequent increases in the share price and in 3 cases to significant increases.

It is unfair that retail shareholders are excluded from this opportunity to profit. Retail shareholders should have the same rights as institutional shareholders. The Primary Bid approach allows this to happen.

On 6 April SRT Marine, via the PrimaryBid Offer raised proceeds of £302,005 through the issuance of 1,208,020 new Ordinary Shares. Together with the Placing and the Loan Notes the Company has raised £2.8 million (consisting of £1.8 million of Equity and £1 million of Loan Notes). This proves the PrimaryBid model works. See https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/SRT/14493943.html

Simon Tucker, CEO of SRT said: “I am very pleased that PrimaryBid has enabled us to include retail investors across the UK in our fund raising. This excellent outcome demonstrates that even in the current extraordinary times, if given the opportunity, UK retail investors are looking to back companies like SRT.”

The question now is why are not all Companies including retail in fund raises, using the PrimaryBid approach?

Cliff Weight, ShareSoc Director Policy and Campaigns

Disclosure. I own shares in SRT Marine but not in any other companies mentioned in this article. ShareSoc does not receive any fees from PrimaryBid from promoting or recommending PrimaryBid.

Hi Cliff – would love to get your view on whether all companies including retail in fund raises, using the PrimaryBid or similar approach?