Last week on-line investment news site Citywire published a report headlined “Tracker fund sales smash records as UK investors pile into passives”. I was the first to add a comment which was “Mindless investment wins out. But at least folks are wising up to open-ended property funds and highly dubious ‘absolute return’ funds”. That generated a number of other comments, mainly from people defending tracker funds.

For example, a couple were: 1) Retail investors, with enough sense to be aware of their limited knowledge of macro-economics & its uncertain effect upon investments, stick to more understandable passives; and 2) Sensible folk realise that indexes will always outperform stockpicker funds in the medium to long-term, give thanks for Samuelson and Jack Bogle and ignore sneers from knowalls.

Let’s take some of those claims. It is certainly true that as the market comprises the whole universe of investors, a general stock market index must reflect the gains and losses of all investors. In other words, if all investors were “active” investors then there would be as many winners as losers. So you cannot achieve outperformance just by deciding to be an active rather than passive investor.

The other problem with active investment is that fund management charges are typically higher than for an index tracking fund. Charges are a major influence over long term returns so an active fund manager has to outperform the index substantially just to offset the higher charges. The flip-side of this is that as index tracking funds do have some charges, plus you may be paying a “platform” charge to hold or invest in them, your investment is bound to underperform the index.

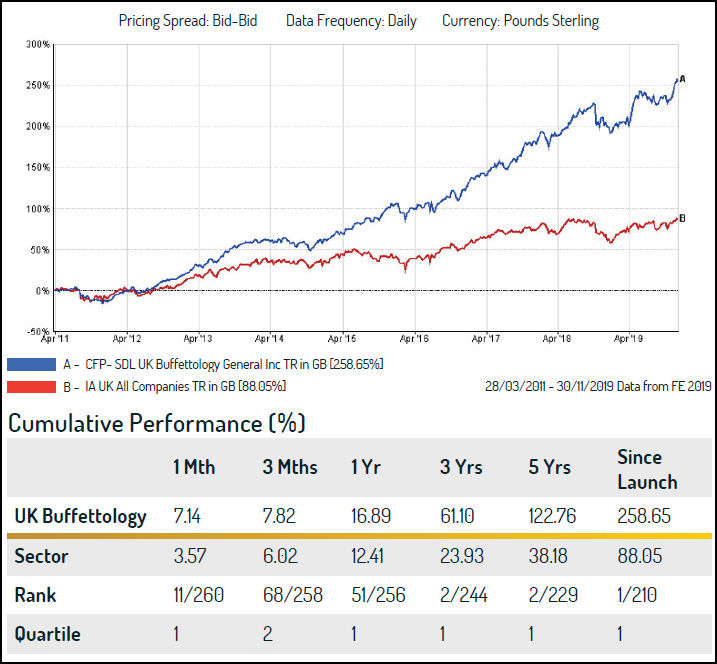

But there are some active investors who do appear to consistently outperform their indices. For example Warren Buffett has done so. The latest example I was reminded of in an email that I received yesterday was the CFP SDL UK Buffettology Fund run by Keith Ashworth-Lord. Below is a chart from their Factsheet dated December 2019 showing the performance of the fund since April 2011 versus a UK All Companies Index and the cumulative performance figures. There appears to be clear outperformance shown.

Keith has been a promoter of “Business Perspective Investing” for a number of years. I recall reading the Analyst magazine with which he was involved and which alas ceased publication many years ago. That publication influenced my own investment approach. Since 2011 he has run the Buffettology Fund which aims to replicate the principles or Warren Buffett and Charlie Munger. In essence he looks at the business first before attempting to value it and is looking for quality businesses with high barriers to entry. Such companies frequently have superior operating margins, superior returns on capital and superior cash generation.

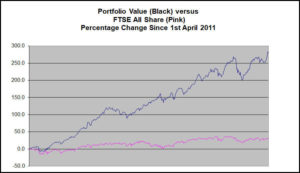

Now readers will not be surprised to hear that I have been following the same principles also and have recently published a book called “Business Perspective Investing” (see https://www.roliscon.com/business-perspective-investing.html ). I thought it would be interesting to see how the performance of my portfolio since 2011 compared to the Buffettology Fund. The chart below gives you the comparison against the All-Share Index:

It looks very similar does it not! Both are nearing a 300% return over the period. The only possible difference is that the chart of my portfolio does not include dividends (i.e. it’s capital only, not total return). Both are focused on UK public company shares but I probably have more smaller companies in the portfolio – and I also have more holdings (85 versus 35 in the Buffettology Fund). But that includes some Venture Capital Trusts (VCTs) that provide minimal capital gains but a lot of tax-free dividends which are not included in the data.

Perhaps you think that otherwise I have the same holdings as Ashworth-Lord in my portfolio? That’s only true to a very limited extent. I only hold 3 of his top ten holdings. So the similarity of performance may relate to holding similar types of companies but not to holding the same companies.

The key point is that both I and Keith Ashworth-Lord have done a lot better than we would have done by simply investing in a FTSE index – about 300% gain instead of 30% in capital terms since 2011.

Have we just been lucky, i.e. is the outperformance likely to continue? It’s very difficult to be certain. John Bogle, whose books are well worth reading, claims there is little evidence of persistent out-performance by fund managers. Managers tend to revert to the mean. This may be because successful managers tend to grow their portfolios as new investors pile in, and the bigger the fund the worse it performs. There are only so many good ideas to pursue.

The other reason why performance tends not to persist is that successful investment strategies can be copied by other investors, thus eroding returns. For example, recently technology-based growth stocks have been seen as the way to make money. Will business perspective investing be replicated by others in future and become too crowded a field? Perhaps but it is not a simple strategy to follow and requires both knowledge and experience.

There have been a number of fund managers with a good track record who have not managed to sustain it. The most recent example is probably Neil Woodford but that is an example of a manager changing his investment strategy. Moving from undervalued medium/large businesses to a ragbag of special situations and early stage companies, some of which were not even listed.

Outperformance does require considerable effort though in analysing companies in depth rather than doing a trivial review of their financial numbers. Understanding the strengths and weaknesses of a business is essential, and keeping a close eye on it after investing is essential.

For a private investor if you don’t wish to do the work of researching individual companies the answer is to invest in a fund or investment trust where the manager follows similar principles and has a long-term track record. Avoid “closet” index trackers, i.e. active funds or trusts whose composition is very similar to their benchmark however much they try to convince you they are pure stock-pickers. You also need to avoid funds/trusts with high management and other overhead charges. You then have a chance of outperforming the relevant index.

If you consider that too risky, and active funds can underperform their index over short periods of time, then a tracker fund or ETF may be the answer for you. You will also avoid the real dogs such as the Woodford Equity Income Fund and some “absolute return” funds. But you certainly need to be aware that investors are currently piling into tracker funds at a record-breaking pace and they accounted for two thirds of fund sales in October. To my mind this is potentially dangerous as people are buying units in these funds without any analysis of the holdings therein, i.e. they are just thoughtlessly buying the index. My original comment on the Citywire article (“Mindless Investment Wins Out”) only refers to the success of fund managers in selling the different types of fund, not to their fund performance!

What has been happening in the last few years is that long-term investment has moved to short-term speculation. When John Bogle started promoting index-tracking and founded the very successful Vanguard business, and for many years after, index tracking was a minority interest among investors. Index tracking funds would have little influence on the index. But is that still the case? There is little evidence to suggest this is so but the return on many large cap shares, which dominate the indices, does seem to be falling. You have to bear in mind that index-tracking funds rarely hold all the shares that make up the index. They can replicate the index by just holding a few of the largest components. So there is a strong herd instinct to invest in the large cap stocks, or disinvest in them.

But large cap stocks, for example those in the FTSE-100, are typically very mature business with low growth prospects and often declining returns on capital.

The length of time that investors hold mutual funds and ETFs has now shortened so the average holding period of a stock ETF is now less than 150 days. They have become tools for short-term traders rather than long-term investors. This has magnified the swings in the market to the benefit of the fund managers and other intermediaries who gain from the higher volumes.

Playing in the large fish pools can therefore be tricky while at the other extreme investing in small or micro-cap stocks can be a triumph of hope over experience. For those reasons, business perspective investing probably works best in mid-cap companies that might be less driven by market trends and share price momentum driven by index trackers.

In conclusion, beware of mindless investment strategies and those who promote them. There are no free lunches in the investment world.

The author does not hold investments in the any of the funds mentioned.

Roger Lawson (Twitter: https://twitter.com/RogerWLawson )

Leave a Reply