by Cliff Weight, Sharesoc Director.

Allenby have just published this very informative review of AIM: http://www.allenbycapital.com/research_1214_2120899233.pdf which contains many interesting statistics.

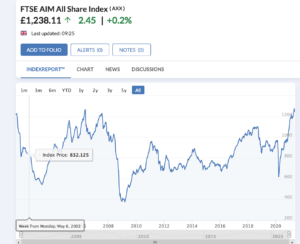

The AIM market is at the same level it was 20 years ago, but the journey between has been very volatile. However the last 5 years, with the exception of last March’s blip, has been most encouraging. It may be that fewer scandals than in the past have occurred. However ShareSoc is still campaigning hard to get better regulation of the AIM market, see https://www.sharesoc.org/campaigns/campaign-improve-aim-market/

Many investors in AIM shares have done very well in recent years.

Allenby report key points are:

AIM Market Update Q1 2021 – All trends in positive direction

The AIM market is currently enjoying a rich vein of success. In Q1 2021, the number of IPOs increased on prior periods as did secondary fundraises, share prices, trading liquidity and the overall number of companies listed on AIM. The £1.03bn raised on AIM in March 2021 was the highest monthly figure since October 2017.

Key takeaways:

- Funds raised in Q1 2021 of £2.0bn are up 98% on the same period last year

- The IPO market is back.

- There were 15 new joiners in Q1 2021 compared to 31 in the whole of 2020 and just 22 in 2019.

- IPOs have been performing strongly post listing. The average return of all 2021 new joiners to AIM has been +62% with a range of -6% (Team Plc) to +235% (Nightcap Plc).

- Increased trading volumes

- The average monthly trading volume of 2.1% of a company’s mkt cap in 2019 rose to 3.2% in 2020 and has averaged 4.2% so far in 2021.

- Q1 2021 also saw the net number of companies on AIM increase by three to 822

- 15 new joiners being offset by 12 departures. Of the 12 leavers, six were due to being acquired.

Leave a Reply